Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

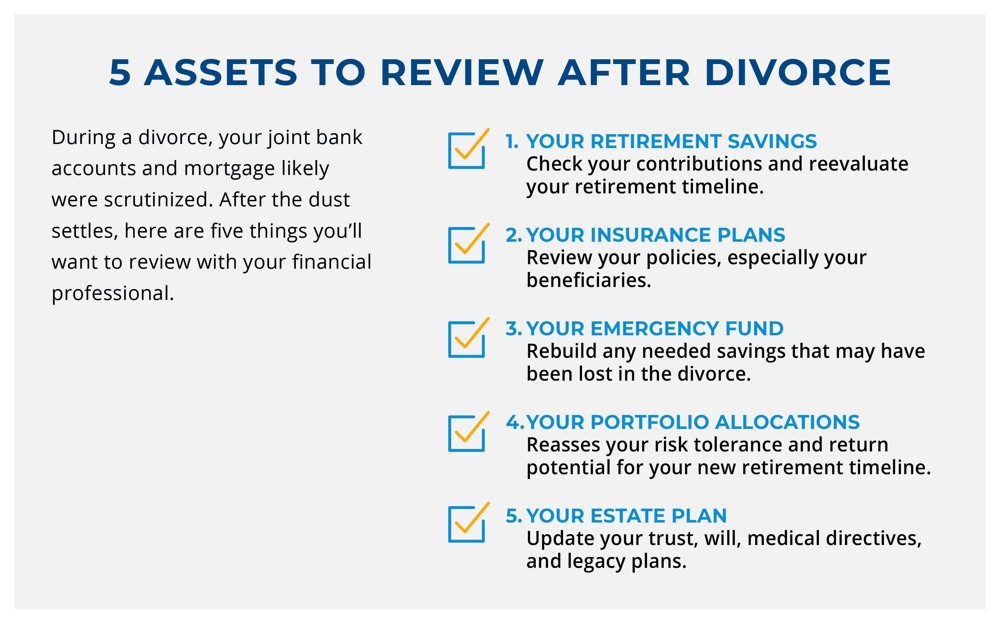

Make sure your retirement plan is still on track.

Whether you were married for just a few years or for decades, the process of divorcing your spouse can create significant emotional and personal hurdles for you. Divorce also creates more financial complexity. With the help and guidance of a financial professional, you will be able to get through it.

If you were part of a couple with intermingled finances or if you have children, things may get complicated. You each face the challenges of disentangling joint accounts and debts while also charting a course for the future of your financial lives. Although the process can be very difficult, there are ways to plan during this uncertain time.

Assessing Your Financial Situation

If you are going through a divorce, the first step toward assuring your future financial stability is to take a detailed inventory of all your assets. Joint bank accounts or shared assets may be subject to court orders that restrict your ability to access, transfer, withdraw, or deplete funds—until your divorce decree details how those assets will be split. Be especially careful, because these court orders may also limit the changes you can make to beneficiaries on your accounts. However, paying attorney fees or continuing with normal spending may be allowed.1

Depending on the laws of the state you live in, you may also need to look at which of your assets are “marital” or “separate” property.

- Marital property, generally, is what you and your spouse acquired during your marriage—the joint bank account where your income goes, but also may include the family cars and your investment accounts.

- Separate property includes assets that were acquired prior to marriage, inheritances or gifts, property you agreed to keep separate, and more.2

The rules around what is marital and separate property are complex, and you should discuss them with an attorney during your inventory.

Making a Plan to Move Forward

Your future may be wide open after divorce—and that includes your financial plan. You should reassess what your future will look like, and how your income and assets will help you pay for it. While you’re busy planning for the future, remember that your current financial responsibilities and budget may change significantly. If you filed taxes as a couple, filing them on your own may change the tax bracket you fall into and may change any deductions you can claim.3

Gray Divorce

Divorce rates are climbing significantly for those who are older—which is often called “gray divorce.” For Boomers aged 50 and older, the divorce rate since 1990 has risen 104%, effectively doubling the number of divorces among older Americans.4

If you are an older divorcee, you’ll want to work closely with a financial professional to make sure your retirement budget and plan are still on track. You may be able to split or roll over your 401(k) and other retirement accounts to avoid having to distribute them early and pay income and/or penalty taxes.5

Additionally, the National Council on Aging provides a range of useful tips for older adults living alone. You can access their "Resources and Support for Older Adults Living Alone: A Comprehensive Guide" on their website.

Working with a Financial Professional

Talking to a financial professional could be intimidating, and understanding financial terms may be confusing: 72% of women agree this is true. But don't discount the benefits of having a financial professional help guide you into your new future. Many financial professionals strive to simplify financial planning through transparency and financial education. During or after a divorce is a good time to start conversations with a financial professional you can trust, so he or she can help you plan your post-divorce financial life.

READ MORE

1 "Automatic Restraining Order," Legal Match, last updated Sept. 6, 2023

2 “Separate and Community Property During Marriage: Who Owns What?” Nolo.com, accessed September 2023

3 “Filing Taxes After Divorce or Separation,” Internal Revenue Service, July 2023

4 “More Baby Boomers are living alone. One reason why: ‘gray divorce’,” CNN, August 2023

5 “How to Split IRAs and Other Retirement Plans During a Divorce,” Investopedia, April, 2023

Pacific Life, its distributors, and respective representatives do not provide tax, accounting, or legal advice. Any taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor or attorney.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company or Pacific Life & Annuity Company. In New York, insurance products are only issued by Pacific Life & Annuity Company. Product/material availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

PL41A