Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

If you’re concerned about saving enough for retirement, planning for a reliable monthly income that lasts for life can help.

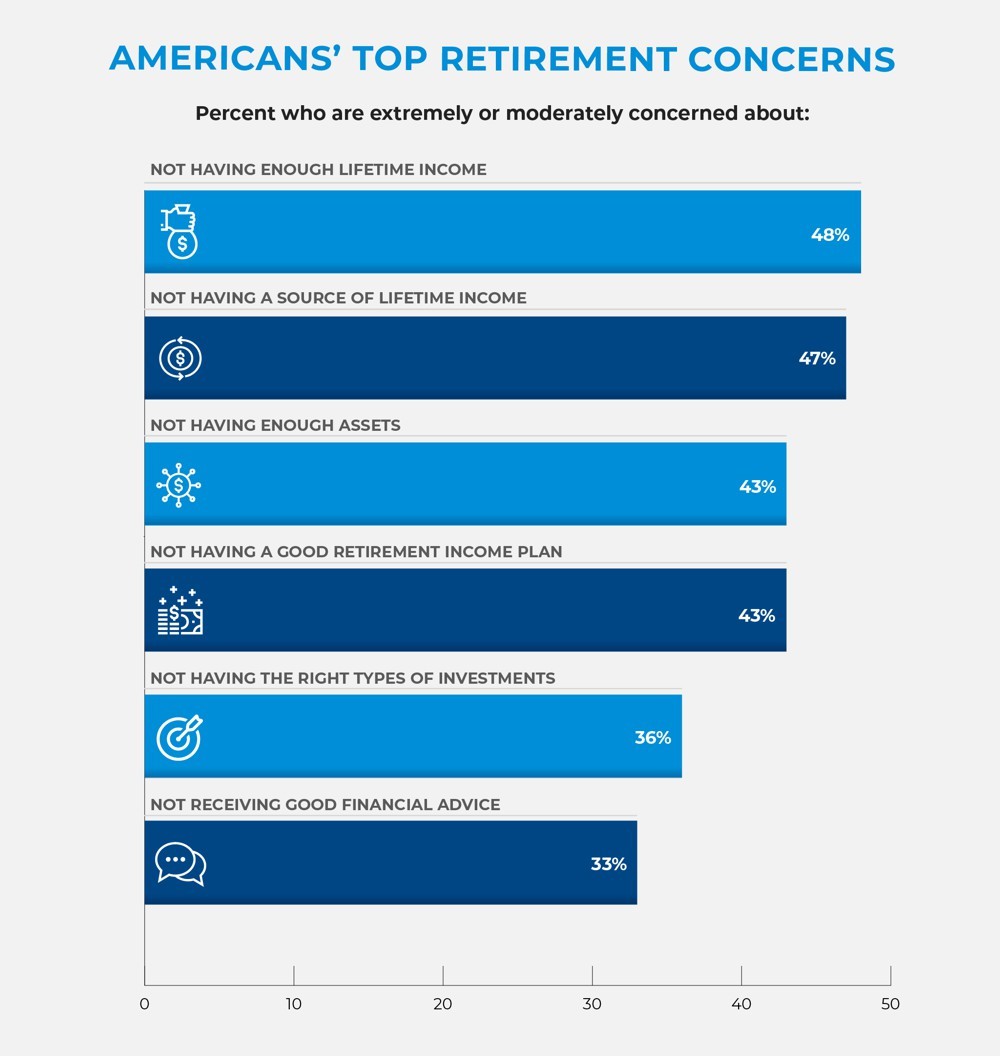

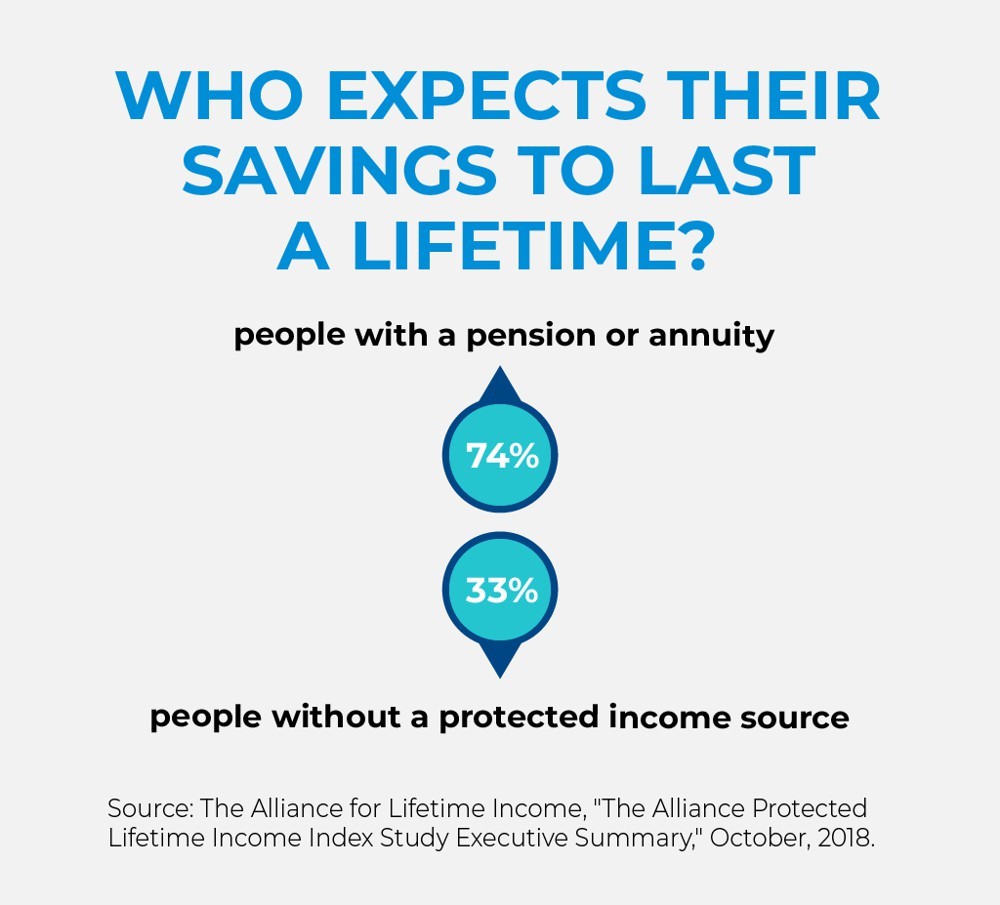

Less than half of all Americans (just 48%) expect their savings to last their lifetime, according to a recent study from the Alliance for Lifetime Income, a nonprofit organization formed by some of the nation's leading financial services organizations. But having a source of reliable monthly income significantly improves retirement confidence. In fact, 74% of individuals with a pension or annuity expect their savings to last their lifetime, compared to just 33% of those without a protected income source. The problem is that the majority of households—62%—lack this kind of savings vehicle.1

The research reveals a troubling trend in retirement preparation—but it also points the way toward a better future for people who plan wisely.

Younger generations are less prepared

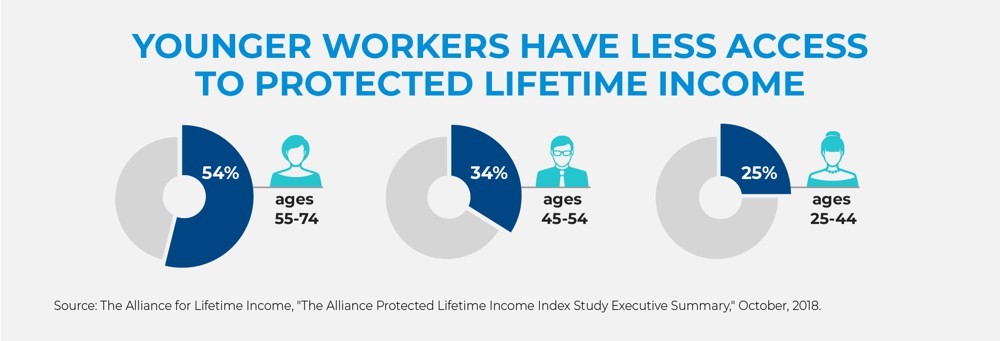

The level of lifetime income is much higher among older generations than younger ones: 54% of people between ages 55 and 74 have a source of protected lifetime income, compared to 34% of people between ages 45 and 54, and just 25% of people between ages 25 and 44.

These numbers tell the story of the decline of pension plans over the past several decades. In the early 1990s, about 35% of private-sector workers participated in a pension plan, according to data from the Bureau of Labor Statistics.2 Today, that figure is just 13%.3

Source: Alliance for Lifetime Income, "The Alliance Protected Lifetime Income Index Study Executive Summary," October 2018.

Retirement accounts aren't always enough

Most workers today are encouraged to save with retirement accounts like 401(k)s and IRAs. These accounts are great for accumulating assets, but they don't address the question of drawing down those assets in retirement and don't provide a guarantee that your retirement savings will last your lifetime.

What's more, the risk of outliving your retirement savings is increasing as life expectancies rise, with about a third of 65-year-olds today expected to live past age 90.4 Social Security can help, but it only provides about a third of retirement income for retirees who have at least $150,000 in assets and do not also have a pension plan or an annuity, according to the Alliance study.

Annuities can help provide income for life

In the face of longer life expectancies and the decline of pension plans, annuities are an attractive option for many to secure lifetime income. Many annuities allow you to grow tax-deferred retirement savings while you work, then provide regular payouts in retirement. What's more, some annuities offer a lifetime payout option that guarantees you won’t outlive this source of income.

The consistent income provided by certain annuities can help cover day-to-day expenses and can also help you shoulder the cost of unexpected expenses by ensuring that you have a regular source of income that won't dry up from month to month or year to year.

READ MORE

1 The Alliance for Lifetime Income, "The Alliance Protected Lifetime Income Index Study Executive Summary," October 2018

2 BLS (https://www.bls.gov/opub/mlr/2012/12/art1full.pdf)

3 Bureau of Labor Statistics. "Retirement benefits: Access, participation, and take-up rates." March 2018.

4 Social Security Administration. "Benefits Planner | Life Expectancy." Accessed June 2019.

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not protect the value of the variable investment options, which are subject to market risk.

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with their accounting or tax professionals for guidance regarding your specific financial situation.

Annuity withdrawals and other distributions of taxable amounts, including death benefit payouts, will be subject to ordinary income tax. For nonqualified contracts, an additional 3.8% federal tax may apply on net investment income. If withdrawals and other distributions are taken prior to age 59½, an additional 10% federal tax may apply. A withdrawal charge and a market value adjustment (MVA) also may apply. Withdrawals will reduce the contract value and the value of the death benefits, and also may reduce the value of any optional benefits.

Under current law, a nonqualified annuity that is owned by an individual is generally entitled to tax deferral. IRAs and qualified plans—such as 401(k)s and 403(b)s—are already tax deferred. Therefore, a deferred annuity should be used only to fund an IRA or qualified plan to benefit from the annuity’s features other than tax deferral. These features include lifetime income, death benefit options, and the ability to transfer among investment options without sales or withdrawal charges.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues. Insurance products and their guarantees, including optional benefits and any crediting rates, are backed by the financial strength and claims-paying ability of the issuing insurance company. Look to the strength of the life insurance company with regard to such guarantees as these guarantees are not backed by the broker-dealer, insurance agency or their affiliates from which products are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability of the life insurance company.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL37