Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Achieving better work-life balance now can help position you for a more fulfilling future.

During the five- to 10-year period before you stop working, mastering a work-life balance can help set you up for a more fulfilling lifestyle in retirement. As a result of the COVID-19 pandemic and work-from-home conditions, many Americans now have a better idea how to juggle work and home life, with the lines between the two more blurred than ever before. Here are the ways creating a better balance between work and home can help put you on the path to a happier retirement.

Embrace new technology and become more tech savvy.

Experiences with Zoom, online chats, and file-sharing platforms today can prepare you for staying connected with friends and family in retirement—no matter how far away they might be. Becoming proficient with the latest technology also will help you be better prepared for the day you may want to organize a charity project or take on a virtual leadership role in an organization you care about.

Reconnect with old pastimes and create new passions.

During your final working years, you’ll likely have more vacation time and more flexibility from the office. And now that work-from-home options are the norm, you likely have more free time without a commute. Use that time to explore hobbies and passions so you can envision how you’ll spend your time and energy away from your career. Whether it’s picking up an old saxophone, spending time with grandkids, or establishing a woodworking shop, favorite pastimes may one day take center stage. Perhaps you can extend volunteer hours or expand work for civic groups. And if you’ve planned for retirement with care and finances are secure, you can look forward to a wide range of leisure activities.

Focus on your health.

A 2018 Harvard University study showed that five habits—not smoking; eating a plant-based, low-fat diet; regular exercise two or more hours per week; limiting alcohol intake to one drink per day for women and two per day for men; and maintaining a healthy weight—can add 14 years of life for women and 12 for men. More significantly, healthy lifestyle choices also can add disease-free years—as much as 10 years without disease for women and eight years without disease for men1. Of course, the longer you live, the longer your retirement savings will need to last. Work with your financial professional or find one here to create a solid retirement plan. You may consider an annuity, which can provide protected lifetime income, along with the benefits of tax deferral. You may also find a way that a cash value life insurance plan, which offers potential tax-deferred cash accumulation, and other tax benefits, can play a role in your retirement plan.

Make decisions about where and how you want to live.

Making more time for family and recreation now can help you make an informed decision about where to spend your future. You’ll have a better idea whether to stay put or make a move for family proximity, financial or healthcare considerations, or lifestyle amenities. U.S. News and World Report’s list of “Best Places to Retire in 2021” names top metro areas for retirees based on factors that include housing affordability, happiness, desirability, retiree taxes, the job market, and access to quality health care—great criteria for you to consider, too.2

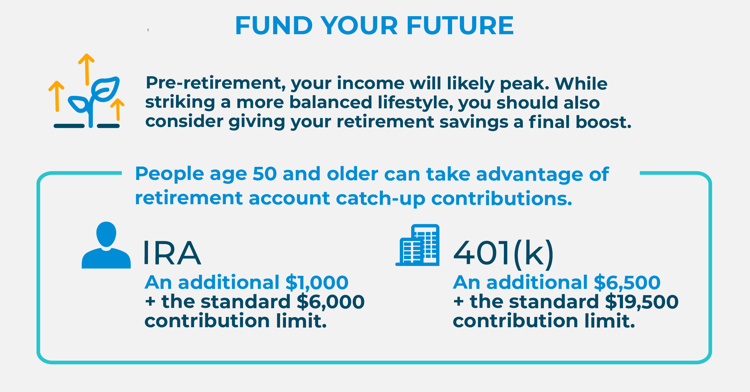

Source: Internal Revenue Service, irs.gov; figures are for 2020 tax year

Source: Internal Revenue Service, irs.gov; figures are for 2020 tax year

READ MORE

1 "Five healthy habits net more healthy years", Harvard Medical School blog, Feb 2020

2 "The Best Places to Retire in 2021", U.S. News & World Report, Oct 2020

The information above, including the results and explanations generated by the calculator, is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with their accounting or tax professionals for guidance regarding your specific financial situation.

Amounts withdrawn from savings vehicles intended for retirement prior to age 59½ may be subject to federal and/or state income taxes and an additional 10% federal penalty tax may apply.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL60