Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Methodically placing assets in several baskets isn’t as thrilling, but helps you invest responsibly.

One way to encourage long-term investment success is to diversify your holdings. When investors diversify, they allocate their money among various asset types and sectors.

The objective isn’t necessarily to boost investment returns. Diversifying your portfolio does not guarantee future results, ensure a profit or protect against loss. The common diversification strategy of adding debt securities (e.g., bonds or Treasury bills) to a stock portfolio could actually result in lower returns over the long term.

Rather, the goal when diversifying is to minimize the effects of market volatility, the way a portfolio’s value fluctuates over time in response to market events. Diversification is based on the premise that different types of investments, or asset classes, generally react differently to various market events.

Managing how volatility impacts your portfolio is one of the ingredients to successful investing: It helps you experience a smoother ride of long-term market growth potential because you’re not taking on all the risk that comes with investing in a single asset class, which could pull you under in the event of a correction, outright bear market in stocks or bad news about individual stocks.

Stabilizing performance

Say you have an extra $50,000 to invest toward retirement or another long-term goal. You could use those funds to buy stock in a well-regarded company. But what if you happen to buy right before a market dive and an executive shake-up that sends the company’s stock tumbling 60 percent? The stock may still deliver a strong return if you give it several years to recover. But would you be comfortable seeing $30,000 of your hard-earned money disappear right off the bat?

For most investors, the answer is no—that’s why they split their money between various asset classes that can offset one another’s worst performance. When one asset class’s strong performance at least partly cancels out another’s weak performance, there is less of a negative effect on your overall portfolio. That stability makes it easier to commit to the long-term financial plan you have established. Otherwise, a sudden drop might make you panic and sell shares at a sharp loss or otherwise abandon your investment strategy, ultimately undermining your financial goals.

Ways to diversify

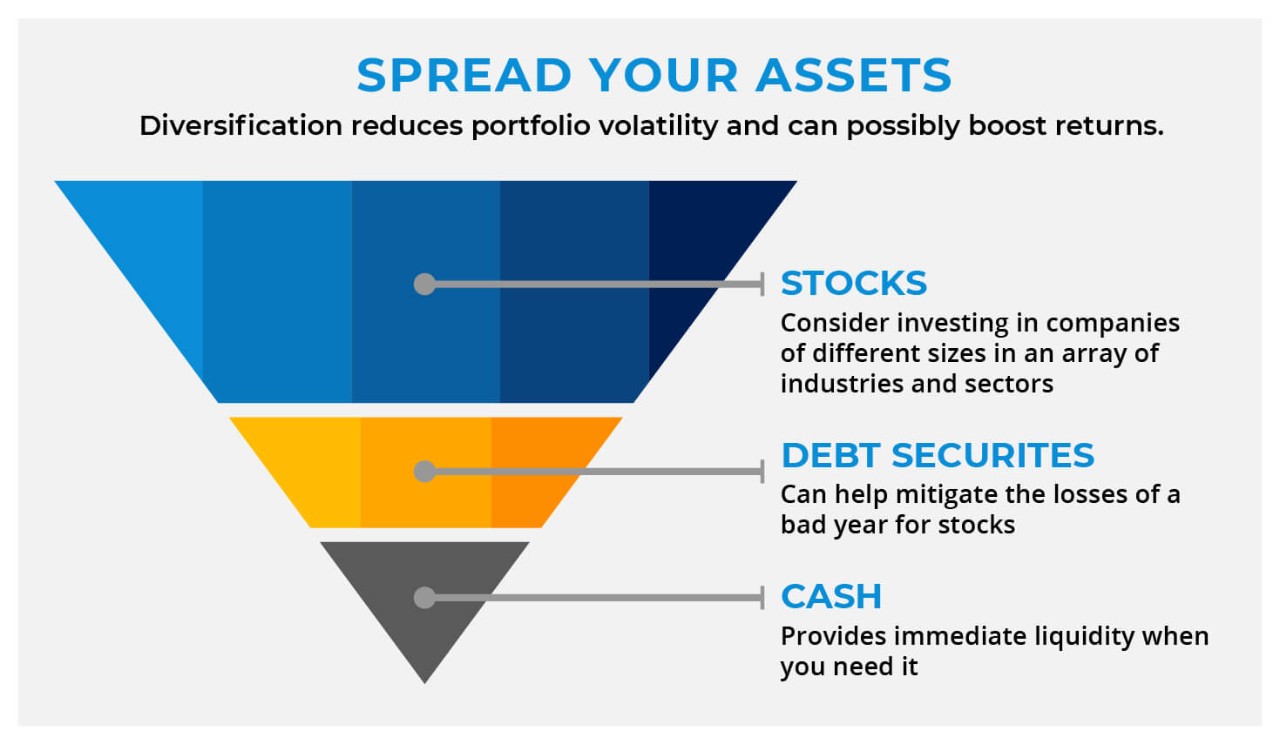

The first step toward diversification involves setting your asset allocation target, which is how you split your investments between stocks, debt securities and cash. Since the ups and downs of the market affect each type of investment in different ways, a strong year for the stock market could mean a weak year for the bond market, and vice versa. So even if you’re investing for a goal that’s several decades out and you’re comfortable taking on risk in the process, keeping a small part of your portfolio in bonds, for example, can help mitigate the losses of a bad year for stocks. Cash, meanwhile, provides immediate liquidity when you need it.

Once your asset allocation is set, you can begin the process of diversification within each asset class. In the stock portion of your portfolio, consider investing in companies of different sizes in an array of industries and sectors. Consider geography, too: Since companies in other parts of the world are subject to unique economic trends, they may generate high returns in the same year that U.S. stocks take a dive. Bonds also offer a number of options within the broad categories of corporate and government debt. See “Spread Your Assets” below for an example of how an investor with 25 years to retirement might divvy up assets.

Diversification is a powerful step on your way to achieving your financial goals. But keep in mind it’s not a step you should take only once. Revisit your plan at least annually to make sure it still aligns with your desired level of risk. One way to help with this effort is to put savings in a target date fund, which will both diversify assets and adjust your investment mix to become more conservative the closer you get to a long-term goal. You should revisit your diversification strategy whenever your financial circumstances change. Together with your financial professional, you can monitor your investment mix to be sure it continues to reflect your goals and time horizon.

READ MORE

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. You should consult with your accounting or tax professional for guidance regarding your specific financial situation.

All investing involves risk, including the possible loss of the principal amount invested. The value of the investments will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. When investing, see the prospectus for a detailed description of investment risks.

PL23A