Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Build a stronger financial foundation with these four steps.

Money—how much we make, how we spend it—is often fraught with emotion. Those emotions can act as obstacles, making it hard to develop a plan to create a solid financial foundation and build wealth.

It can be helpful, however, to think about financial goals in incremental steps. The way forward to a stronger financial foundation starts with identifying goals, then breaking those down into actionable, attainable steps. Having a plan in place can help you be more confident about your money and put you on the path to a stronger financial future. Here are four smart money moves to help make your money work for you.

Prepare yourself for the unexpected

Unexpected events, like house repairs, medical emergencies, or job loss, can dent even the most carefully planned budgets. That’s when an emergency fund comes in handy. That cushion helps minimize the financial disruption that comes from unexpected costs.

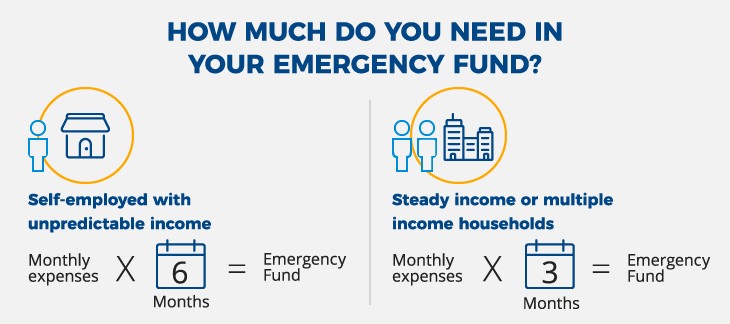

So, how much should you put into an emergency fund? This can vary depending on your job and what stage of life you’re in. For someone who runs their own business where income might be more unpredictable, it’s ideal to put away more money. In that case, you might want to aim for an emergency fund with six months of income. On the other hand, for someone with a steady job or who is in a family with multiple incomes, three months of income could be enough.

An emergency fund is just one way to protect yourself when unexpected costs come up. Another financial cushion comes from life insurance, which plays an important role in protecting our loved ones financially. The primary purpose of life insurance is death benefit protection, so your family members don’t have to worry about how to pay the bills if you’re not around. Talk to a financial professional for more information about life insurance.

Maximize your benefits

Another smart money move is to take advantage of any employee benefits available to you. Depending on the company, those benefits could include matching 401(k) contributions, flexible spending accounts, or student loan assistance. They also come in the form of discounts, hotel stays, gym memberships, disability insurance, or financial planning assistance. You can ask your company's HR department to see what is available for you.

Pay off debt

Debt is a common stumbling block for most Americans when it comes to reaching their long-term financial goals. Make a plan to pay off debt, whether it’s credit card debt, car payments, student loans, or medical debt.

There are two common approaches to paying off debt:

- The “snowball approach” means you start with the smallest balance first. The reasoning here is that paying off the smallest balance first gives you a quick reward, encouraging you to move on to other balances.

- The “avalanche method” means you pay off debt with the highest interest rate first because that’s the kind that costs the most to keep.

Look to the future

Last, an important part of strengthening your finances is to plan for long-term goals, like retirement. Social Security on its own may not be enough to fund your retirement lifestyle. But saving in tax-deferred accounts, such as a 401(k), allows your money to grow tax-deferred until you retire, which can help maximize your savings and ensure you’ll have what you need for the future.

For those without an employer-sponsored plan, there’s also traditional Individual Retirement Account (IRA) or Roth IRA accounts, which also offer tax savings and are designed to help people save for retirement.

An annuity is another way to ensure a steady income in retirement. Annuities are designed to help grow, protect, and manage retirement savings. Outside of pensions and Social Security, annuities are the only financial vehicle that can provide protected lifetime income. There are various types of annuities that provide different benefits. Talk to a financial professional about which option might be best for your circumstances.

Yet another future goal might be saving for your children’s college funds. Putting money into a college savings account has advantages over a traditional bank account because of the ability for your money to grow tax-free over time.

Thinking about money and the future can be stressful. But like many other areas of life, creating a simple, actionable plan to reach your goals can help build your confidence and put you on the path to success.

READ MORE

In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

All guarantees are subject to the claims-paying ability and financial strength of the issuing insurance company and do not protect the value of the variable investment options, which are subject to market risk.

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with your accounting or tax professional for guidance regarding your specific financial situation.

Annuity withdrawals and other distributions of taxable amounts, including death benefit payouts, will be subject to ordinary income tax. For nonqualified contracts, an additional 3.8% federal tax may apply on net investment income. If withdrawals and other distributions are taken prior to age 59½, an additional 10% federal tax may apply. A withdrawal charge and a market value adjustment (MVA) also may apply. Withdrawals will reduce the contract value and the value of the death benefits, and also may reduce the value of any optional benefits. Life insurance is subject to underwriting and approval of the application.

All investing involves risk, including the possible loss of the principal amount invested. The value of the variable investment options will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please see the prospectus for a detailed description of investment risks.

Under current law, a nonqualified annuity that is owned by an individual is generally entitled to tax deferral. IRAs and qualified plans—such as 401(k)s and 403(b)s—are already tax‑deferred. Therefore, a deferred annuity should be used only to fund an IRA or qualified plan to benefit from the annuity’s features other than tax deferral. These include lifetime income and death benefit options.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL67