Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Having an estate plan is essential to maintaining your family’s financial security.

You want nothing more than the well-being of your family — and that includes their financial security. That’s why it’s so important to think about how you can continue protecting them financially even beyond your own lifetime, or in case you become ill or incapacitated.

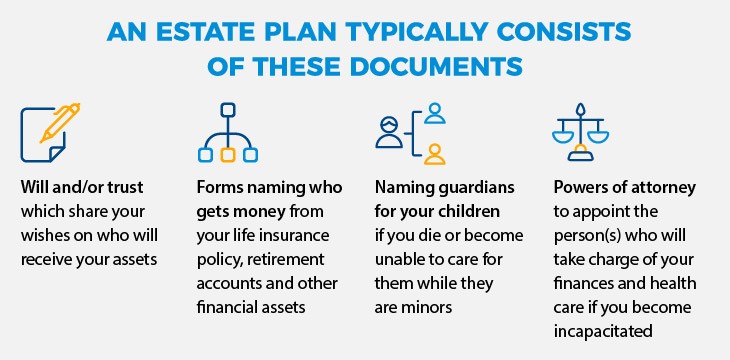

The most effective way to ensure your assets are used in the best way to provide for your family’s needs is to have an estate plan, which is basically a set of documents that say who will receive your assets, who will care for your children, and who can make decisions on your behalf.

Yet, as the National Association of Estate Planners & Councils notes, an estimated 56% of Americans don’t have an up-to-date estate plan.

If you’re among those who haven’t yet made an estate plan, the first step is to understand what it involves.

Here’s a look at how these basic estate planning documents work and what you should do to ensure the timely, proper execution of your estate plan.

Keep in mind that it’s a good idea to consult a tax professional or an attorney for help in drafting your estate planning documents. Another option is to use will-writing software or fill out templates available online. However, if your estate involves a complex set of assets and circumstances, it’s probably best to hire an experienced professional rather than take the do-it-yourself route.

Will and Trusts

Both wills and trusts indicate your wishes regarding who will receive your assets. The main difference between them is that a will is only enacted after your death, while a trust can become effective while you are still alive.

Once you have created your will, you can appoint a person, called an executor, to be in charge of distributing your assets the way you’ve specified in the document.

A trust authorizes a third party — the trustee — to hold your assets on behalf of someone you want to receive them later. A revocable trust, also known as a living trust, can end any time you decide, and it typically dissolves automatically when you die. An irrevocable trust is one that you cannot change once you have established it.

An estate attorney can guide you in making sure the will or trust you prepare is legally valid.

Naming Beneficiaries

As part of your estate plan, you will need to state who will get the proceeds from your life insurance, retirement plan and other financial accounts when you die. The paperwork for these accounts includes spaces for you to list beneficiaries. Most people choose family members, but a trust, a nonprofit organization and even your estate itself can be a beneficiary.

Guardianship

If you have minor children, you should specify in your will the people you want to take care of them if you die and they have no other parent.

The guardian you choose to raise your child or children will also be in charge of managing the assets they inherit.

LGBTQ+ couples with children may need to take additional steps to ensure that the surviving parent is recognized as the legal guardian when one of them dies. Because only biological parents automatically receive that right, a court judgment or adoption is usually the only way a non-biological parent can become a legal guardian.

Powers of Attorney

A power of attorney (POA) lets another person of your choice (your agent) make decisions on your behalf if you become unable to carry them out yourself. That incapacity could be either physical or mental. This estate planning document comes in two basic types: a durable POA, which covers decisions about financial and legal matters, and a healthcare POA, which covers decisions about your medical care.

The most important thing is to act sooner than later when it comes to your estate planning. Getting these documents in order will ensure that your family understands and can carry out your plans to provide them with a financially secure future.

Please note: According to the Tax Cuts and Jobs Act of 2017, the federal estate, gift and generation-skipping transfer (GST) tax exemption amounts are all $10,000,000 per person (indexed for inflation effective for tax years after 2011); the maximum estate, gift and GST tax rates are 40%. In 2026, the federal estate, gift and generation-skipping transfer (GST) tax exemption amounts are scheduled to revert to $5,000,000 per person (indexed for inflation for tax years after 2011).

READ MORE

Sources

National Association of Real Estate Planners & Councils, “National Estate Planning Awareness Week,” accessed March 23, 2022, https://www.naepc.org/events/awareness_campaigns

U.S. News & World Report, “How to Choose a Guardian for Your Child,” June 4, 2019, https://money.usnews.com/money/personal-finance/family-finance/articles/how-to-choose-a-guardian-for-your-child

CNBC.com, “Estate planning for LGBTQ+ families is crucial: Here’s what you need to do,” June 24, 2021, https://www.cnbc.com/2021/06/24/-estate-planning-for-lgbtq-families.html

In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with your accounting or tax professional for guidance regarding your specific financial situation.

The calculator tool above was designed for you to conduct a basic self-assessment of your needs and are only meant to provide you with a rough estimate. For a more in-depth and overall analysis of your specific situation and needs, please contact your Financial Professional or Life Insurance Producer.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL69