Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

A life insurance trust can help provide your estate plan with flexibility and protection from an uncertain future.

Estate planning is an important step in organizing your assets for future generations. Perhaps you hope to pass down the family business or leave enough money to help pay for your grandchildren’s college tuition. To meet your estate planning goals, you must carefully consider the effect of uncertainties, such as estate tax implications and the possibility that your own financial needs may change over time.

For instance, a serious hospital bill could force you to tap into the assets you’ve put aside, while a divorce or shift in familial relationships could prompt you to change your list of beneficiaries or the specifics of the asset distribution. It’s wise to incorporate flexibility into your plan up front to protect your estate and have access to your money when you need it.

Tax protection

Life insurance’s primary purpose is to provide protection against the premature death of the insured. However, life insurance policies can be useful in other situations as well. High net-worth married couples who are concerned with estate taxes may want to consider creating an irrevocable life insurance trust (ILIT) that allows the trustee of the ILIT to buy and hold a life insurance policy in the trust. An ILIT offers several benefits: The policy may be able to be funded with lifetime gifts1, a tax-free annual gift,2 and, if the ILIT is properly drafted, the value of the policy should be excluded from your total taxable estate. The trustee of the ILIT may also be able to use the tax-free death benefit3 to pay taxes and other estate settlement costs.

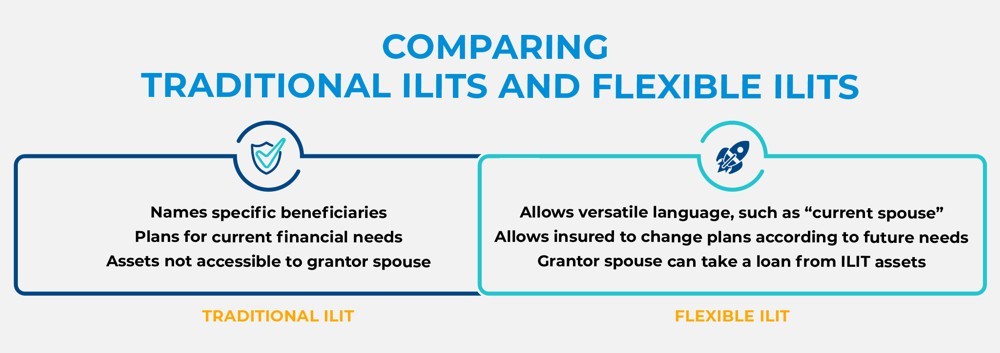

An ILIT enables a grantor-spouse to name specific beneficiaries. Depending on the terms of the ILIT, the beneficiaries may be able to receive distributions of the death benefit proceeds at the insured(s) death.

Options for added flexibility

Married couples seeking more versatility than the traditional ILIT provides may want to consider incorporating a flexible ILIT into their estate plan. In a flexible ILIT, one spouse is the grantor of the trust and the other is the beneficiary. Under the flexible ILIT’s terms, the trustee (a friend, advisor or extended family member) may be given the discretion to make distributions to the spousal beneficiary for any reason—even to the exclusion of other beneficiaries. This rule potentially provides an avenue for the trust to unwind and return the assets to the couple’s estate, if the trust is no longer needed for estate planning purposes.

If the grantor spouse has concerns about losing indirect access to the trust in the event of a divorce or the death of the spousal beneficiary, additional flexibility can be incorporated in two ways. Because the trust allows adaptable language such as “my current spouse” to name the beneficiary, the assets can be held without distribution until the grantor remarries. A flexible ILIT may also allow the trustee to make loans to the grantor spouse, which may entail the trustee accessing the policy’s available cash value if necessary4. This feature can be helpful if the spousal beneficiary should pass first.

A solution for an uncertain world

Whether you’re looking for added protection from estate tax liability or being proactive in preparing for life’s unforeseen circumstances, it’s smart to build flexibility into your estate plan. Using flexible ILITs as part of a comprehensive estate plan allows you to remain in greater control of your assets, helping you ensure the best possible outcome for you and your loved ones.

READ MORE

- It should be noted that although the IRS has announced that the lifetime estate and gift tax exemption will increase to $13.61 million in 2024, under current law, that amount will be decreased by half at the start of 2026.,

- As of January 1, 2024, the annual gift tax exclusion is $18,000 per donee.

- For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2) (i.e. the transfer-for-value rule); arrangements that lack an insurable interest based on state law; and an employer-owned policy unless the policy qualifies for an exception under IRC Sec. 101(j).

- Loan has to be adequately secured and bears an adequate interest rate equal to the applicable federal rate (AFR).

The results and explanations generated by the tool on this page may vary due to user input and assumptions. Pacific Life does not guarantee the accuracy of the calculations, results, explanations, nor applicability to your specific situation. We recommend that you use this calculator as a guideline only and ultimately seek the guidance of an experienced professional. CalcXML, the provider of this information and interactive calculator, is an independent third-party and is not affiliated with Pacific Life.

Life insurance is subject to underwriting and approval of the application and will incur monthly policy charges.

Pacific Life, its affiliates, their distributors and respective representatives do not provide tax, accounting or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney.

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with their accounting or tax professionals for guidance regarding your specific financial situation.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company or Pacific Life & Annuity Company. In New York, insurance products are only issued by Pacific Life & Annuity Company. Product/material availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

PL35A