Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

An annuity with a predetermined beneficiary payout option can offer greater control without a trust.

Leaving an inheritance to your loved ones isn’t just about passing on assets—it’s also about ensuring that the people you care about are well equipped to handle what they’ve received. If your heirs are young or you have concerns about their ability to manage money, you may want a way to control not only how much money they receive, but also when and how they receive it.

To take advantage of this opportunity while avoiding the effort and expense required to set up a trust, you might want to consider adding a predetermined beneficiary payout option to an annuity contract. This option provides a range of alternatives for how much inheritance your beneficiaries receive, as well as when and for how long they receive payments.

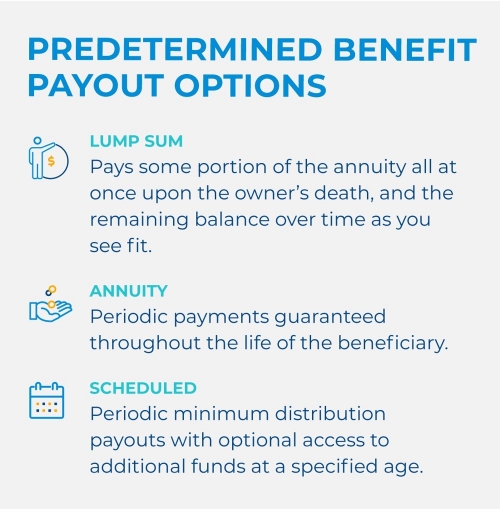

Consider the following payment options:

Lump sum payouts

When you opt for a lump sum payout, you specify an amount of money your beneficiary will receive upon your death. Typically, that amount will be a percentage of the assets in the annuity, with the remainder to be paid out over time using one of the other payout options below (see “Predetermined Benefit Payout Options”). This scenario provides a way to cap the amount a younger beneficiary inherits initially, in circumstances where they don’t need immediate access to all the money in the annuity.

Regular annuity payouts

It’s also possible to have your annuity make periodic payments to a beneficiary. This option works well when you want to avoid lump-sum payments, such as a situation in which a beneficiary has trouble managing their finances. By choosing an annuity payout, you ensure your beneficiary receives a secure income stream from their inheritance.

You can choose between two options when it comes to annuity payouts. A life-only annuity makes payments throughout your beneficiary’s lifetime. Using a life-with-period-certain option, you can also specify a period of time over which you’d like to guarantee payments. The latter option provides an opportunity for an older beneficiary to pass the remainder of the guaranteed payments to their own beneficiary if they die before the period ends.

Scheduled payouts

For additional control over how much your beneficiaries receive, you can choose scheduled payouts. With this option, heirs receive a minimum distribution annually, calculated based upon their life expectancy at the time the owner of the annuity passes away. Unlike a life-only annuity, however, these payments only last until the funds in the annuity run out, which means your beneficiary could outlive the distribution payments.

Alternatively, you can specify an age at which your beneficiary gains access to any distributions greater than the minimum. This approach works well when younger beneficiaries don’t need immediate access to their inheritance funds, but you want to give them extra support as they mature. For example, you may want to hold their inheritance back until they leave college and are ready to purchase a home or start a family.

A tool that offers maximum flexibility

You don’t necessarily need to treat all your beneficiaries exactly the same way. If your heirs differ in age or ability to manage money, a predetermined beneficiary payout option can restrict access to funds for some of them, while allowing others the flexibility to receive their inheritance as they see fit.

READ MORE

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not protect the value of the variable investment options, which are subject to market risk.

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with their accounting or tax professionals for guidance regarding your specific financial situation.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL32A