Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Weigh your choices before deciding where—or whether—to move your retirement savings when you switch employers.

A new job brings lots of changes. As you get set up with new projects, new bosses and new benefits, you should also think about what to do with your old 401(k) plan. Luckily, you have options.

1. Leave your money where it is

Some employers will allow you to keep your money in an existing 401(k) account, so you may be able to leave your retirement savings where they are as long as you meet the plan requirements to do so. You won’t be able to add new money to the account, however.

In making this decision, look carefully at any benefits you might lose before moving your retirement savings. If your old plan offers benefits that your new plan does not offer, like lower expenses, more services or better access to loans, abandoning those services may not be worthwhile. You might also want to do this if you are 55 and anticipate needing the money at a later time, but before age 59½.

2. Withdraw your money

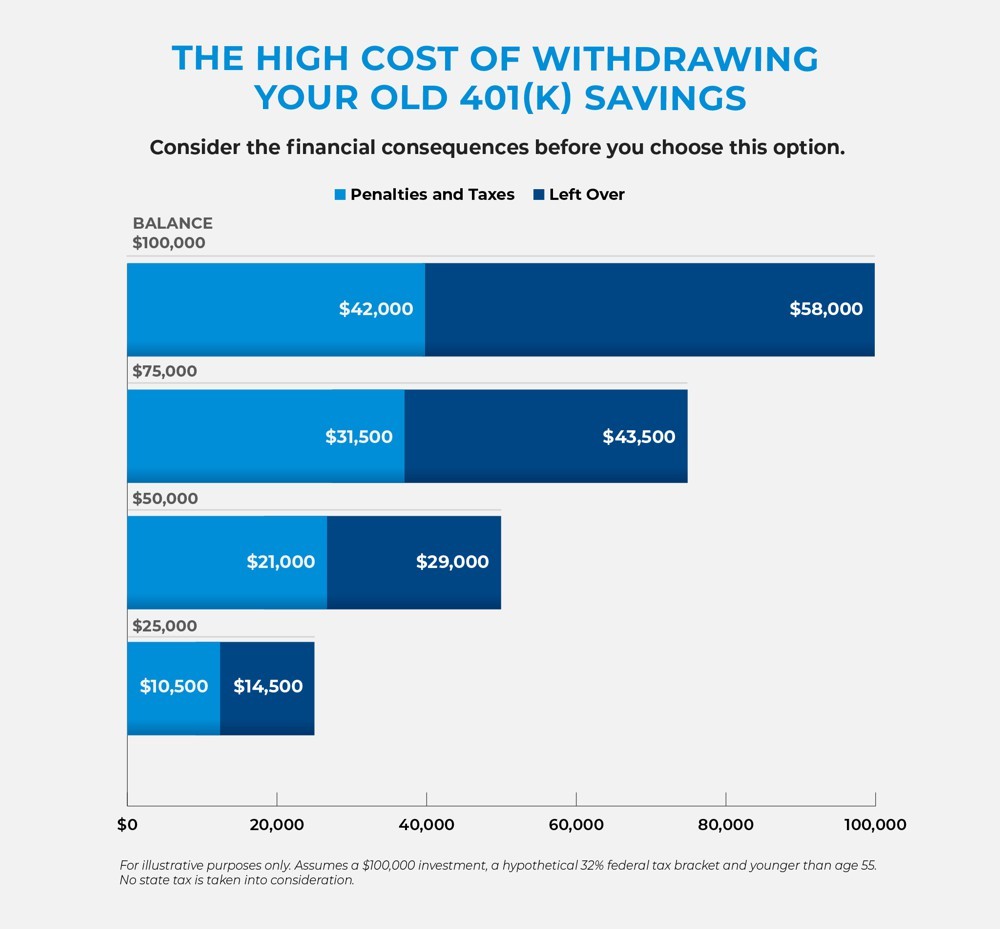

If you decide to withdraw your retirement savings, make sure you understand the consequences. Because most retirement funds come out of your paycheck pre-tax, the government will tax your withdrawal at your current income tax rate. You also could be charged an additional 10% early withdrawal penalty if you’re under age 55. If you wind up in the 32% tax bracket because of that extra income, that can eat up as much as 42% of your retirement savings.

3. Roll over to your new employer’s 401(k) plan

If you decide against leaving your old plan alone, you can move your retirement savings to a new plan, a process known as a rollover. For simplicity’s sake, putting your retirement savings in one place decreases your financial paperwork and makes it easier to keep an eye on your balances.

If your new plan allows incoming rollovers, you can complete the transaction in one of two ways.

With an indirect rollover, you withdraw your existing retirement savings from your old plan. To avoid penalties, you’ll need to move those savings into another retirement plan within 60 days. The IRS requires your previous employer to withhold 20% of the distribution to pay taxes, so you’ll need to have enough cash on hand to make up that extra 20% when you fund your new account to achieve a complete rollover. You’ll eventually get that money back in the form of a tax refund.

Unless you plan to use some portion of your retirement savings during the 60-day period, you may find a direct rollover to be simpler. In a direct rollover, you simply tell your previous employer to transfer your retirement savings directly to your new employer’s retirement plan. That way you never touch the money and don’t have to worry about taxes, penalties or the 20% mandatory withholding.

4. Roll over to an IRA

You can also roll over your retirement savings from your old 401(k) plan into an individual retirement account (IRA). Like rolling over to your new employer’s 401(k) plan, rolling over to an IRA can help you consolidate your accounts and simplify your recordkeeping.

The best choice typically comes down to the details for each option. You may find that an IRA gives you a wider variety of investment choices than your employer’s plan does. It can also be a good idea to compare expenses between plans to make sure you maximize your retirement savings over the long term.

Whatever you choose, making a smart decision now can help keep you on track to meet your retirement goals.

READ MORE

Pacific Life, its distributors, and respective representatives do not provide tax, accounting, or legal advice. The above is provided for informational purposes only and should not be construed as investment, tax or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with your accounting or tax professional for guidance regarding your specific financial situation.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL39A