Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

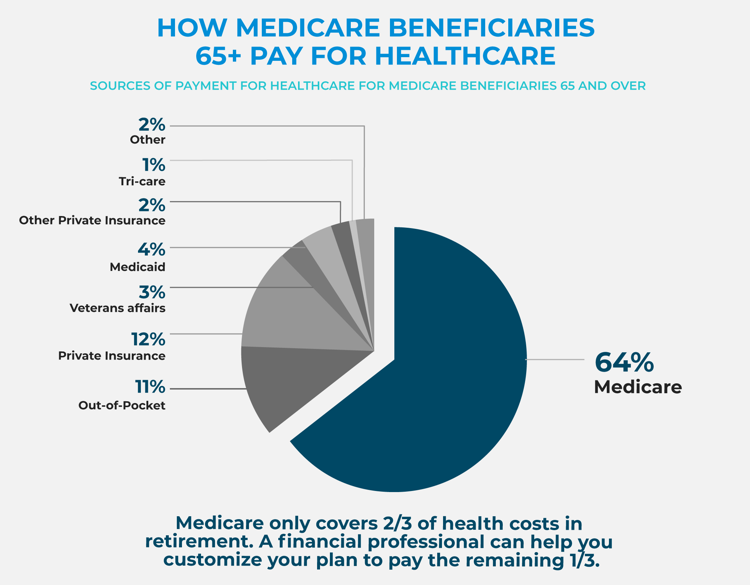

Trying to anticipate what you’ll spend on healthcare in retirement can seem daunting, but estimates can help you start preparing for the future.

Healthcare is a retirement budget line item you don’t want to ignore. In fact, a recent study from Fidelity calculates that a couple in retirement will require $280,000 for medical costs.1 And the Employee Benefit Research Institute (EBRI) reports that some couples might need to have as much as $325,000 put away for healthcare, depending on their circumstances.

The good news is that Medicare offers great options to help cover costs. And even better, a 2020 EBRI report2 says that a new formula used by the Medicare trustees resulted in an 8 percent to 10 percent dip in the savings amount that a retired couple might need in retirement.

Still, as of 2020, Medicare generally covers only about two-thirds of the cost of healthcare services for Medicare beneficiaries ages 65 and older, according to EBRI. So, it’s wise to consider where the remainder will come from. A little research can help you find the most cost-effective way to combine Medicare options with personal savings to pay for healthcare in retirement. It’s reassuring to know that you have options.

Source:

Employee Benefits Research Institute: EBRI Insights, May 16, 2019, No. 481.

“Savings Medicare Beneficiaries Need for Health Expenses in 2019: Some Couples Could Need as Much as $363,000”

Source:

Employee Benefits Research Institute: EBRI Insights, May 16, 2019, No. 481.

“Savings Medicare Beneficiaries Need for Health Expenses in 2019: Some Couples Could Need as Much as $363,000”

Make sense of the options and save

As you begin delving into how much you should save toward future healthcare costs, a financial professional can help you plan and prepare. Together you can find solutions that keep in mind your best interest—from both a health and financial perspective.

You’ll benefit from starting the planning process early. Set up an appointment to strategize with your financial professional about your Medicare-related decisions before you approach age 65. That will give you time to understand and think through your options without the pressure of an enrollment deadline.

Key points to cover include:

- Your available retirement income sources for out-of-pocket medical costs and premiums related to whichever Medicare plan you choose. Income sources may include Social Security, pensions, and annuities.

- How long you anticipate needing those income sources to cover healthcare costs. With rising life expectancies, consider that an annuity can guarantee a stream of income for as long as you live.

- Keep in mind that while Medicare Part B premium cost is tied to your income level, the Medicare formulas that determine what premium price you’ll pay don’t include distributions from Health Savings Accounts, Roth IRAs, or cash value life insurance policies.3

You’re in control

Planning for healthcare costs now can give you confidence about your finances in retirement―even as National Historic Expenditure data4 projects that medical spending in the U.S. will grow 5.5% between 2018 and 2027.

Now’s the time to make choices about where to put your retirement savings and how to save. These choices can set you up for potentially robust streams of income. There are options that can allow you to pay for healthcare costs in stride during retirement—with less stress or worry. Your financial professional can help you home in on the options that are best for you.

READ MORE

1 Fidelity, “A Couple Retiring in 2018 Would Need an Estimated $280,000 to Cover Health Care Costs in Retirement,” April 19, 2018.

2 Employee Benefits Research Institute, “Savings Needed for Medicare Beneficiaries’ Health Expenses Declines,” May 28, 2020

3 Thebalance.com, “How to Plan for Health Care Costs in Retirement,” Aug. 29, 2019.

4 National Health Expenditure (NHE) historical data (1960–2017), Centers for Medicare & Medicaid Services (CMS), cms.gov; and NHE projections (2018–27), CMS, cms.gov. https://www.chcf.org/wp-content/uploads/2019/05/HealthCareCostsAlmanac2019.pdf

The information above, including the results and explanations generated by the calculator, is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with their accounting or tax professionals for guidance regarding your specific financial situation.

Amounts withdrawn from savings vehicles intended for retirement prior to age 59 1/2 may be subject to federal and/or state income taxes and an additional 10% federal penalty tax may apply.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL59