Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

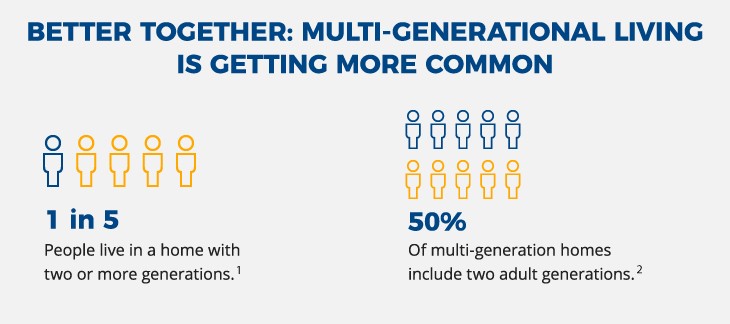

Tips for families with many generations living together so everyone stays financially healthy.

When multiple generations of a family live under one roof, it can be a bit more challenging to set priorities and keep on track with goals like retirement or education savings. Having grandparents, grandkids, parents, aunts, uncles or cousins living together can mean balancing different financial needs.

But, of course, there also are many benefits to multiple generations living together. Besides the emotional support that comes with living with loved ones, there’s the added bonus of sharing expenses. Here are some tips for extended families living together so everyone stays financially healthy.

1 Pew Research Center, The demographics of multigenerational households, accessed June 2022

2 Pew Research Center, A record 64 million Americans live in multigenerational households, accessed June 2022

Talk about finances

It can be difficult to talk about money openly, but being proactive about the discussion can help prevent disagreements later. You can start such a discussion by asking each family member to talk about their priorities, including how they can help out financially and how much financial help they might need.

Grandparents, for instance, might have some chronic health conditions that could require full-time care now or in the near future. Or maybe your kids are headed to college in a few years and need help building their savings. Nothing has to be decided right away or in one discussion, but talking about everyone’s priorities helps open the dialogue.

While you’re talking about your family members’ priorities, think about your goals and needs, too. Remember that helping to support your parents or other family members financially doesn’t mean you have to sacrifice your own future. Your financial goals and needs are a priority, too, including saving for your retirement.

Of course, there may be competing priorities. Speaking with a financial professional can help you create a plan that balances both current and near-term needs, as well as longer-term goals.

Discuss responsibilities

As part of the discussion about finances, include some agreement about how to handle expenses, shared or otherwise. Then, you can create a family budget so everyone knows how they fit in.

One example: An adult child moving back in may need some financial help while paying down debt. They could pitch in by contributing to groceries or utility bills or help out with tasks such as cooking or cleaning. They also may need to work from home and want to upgrade to a more expensive internet package. If it’s not a priority for anyone else, maybe they can pay for the upgrade. Work out a plan and agree on how everyone can contribute, whether financially or by helping out with tasks.

Plan for and save for the future

Many expenses can be planned to some extent. To come up with a plan to cover them, start by listing out near-term expenses and when you’ll need those. Then, start saving money accordingly. The same goes for longer-term goals. Whether it’s caring for an aging parent, helping to pay for a child’s education, or funding your own retirement, consider how much you might need to reach those goals.

Multigenerational living can come with challenges given the competing interests. But it also can be a case of “better together,” especially when everyone communicates and participates in the plan.

READ MORE

In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

All guarantees are subject to the claims-paying ability and financial strength of the issuing insurance company and do not protect the value of the variable investment options, which are subject to market risk.

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with your accounting or tax professional for guidance regarding your specific financial situation.

The calculator tool above was designed for you to conduct a basic self-assessment of your needs and are only meant to provide you with a rough estimate. For a more in-depth and overall analysis of your specific situation and needs, please contact your Financial Professional or Life Insurance Producer.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL68