Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Don’t let these common misconceptions prevent you from giving your family the protection they deserve.

We all want what’s best for the people we love. Life insurance primarily provides death benefit protection, and it can help protect your family’s financial well-being and secure their future. But these common myths can keep people from getting their family the protection they need. Here, we dispel six misconceptions.

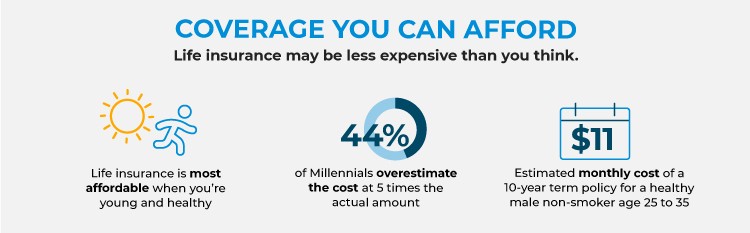

Myth: Life insurance is too expensive.

Most consumers overestimate life insurance costs, and millennials do so by as much as five times1. You’ll never have more affordable insurance options than when you’re young and healthy1. In fact, one survey places the cost of a 10-year term policy for a healthy male non-smoker age 25 to 35 to around $11 per month2.

Myth: If you’re young and healthy, you don’t need life insurance.

In your 20s and 30s, you’re likely to be in good health. But if you die unexpectedly, life insurance can help your beneficiaries with expenses and can leave them more financially secure without your income.

Myth: If you have an impairment, life insurance could be out of reach financially.

Not true, say the experts. Many insurance carriers, including Pacific Life, have affordable options for those with pre-existing conditions, such as diabetes and hypertension.

Myth: Life insurance is only for people with young children.

Should something happen to you, you want to make sure your partner is taken care of. And certain kinds of insurance, such as cash value life insurance, can play a crucial role in retirement planning for couples with or without children.

Myth: If you have life insurance through your employer, you don’t need any additional coverage.

If your workplace benefits include life insurance, that’s great, but one or two times your salary may not be enough to meet your family’s needs. And if you lose your job, you may lose your life insurance coverage. You may want to consider supplementing it with a private policy as well.

Myth: Life coverage can easily be renewed when the coverage experience expires.

By the time your term policy is up, your health may prevent you from easily getting another policy. And because premiums naturally increase with age, renewing may be cost prohibitive, which is why it’s best to get a term policy sooner rather than later. If you anticipate needing life coverage beyond the length of that term, consider a cash value policy. Work with a financial professional to ensure you have the coverage you need as part of your overall financial plan.

READ MORE

1 Facts + Statistics: Life insurance, Insurance Information Institute, retrieved Feb 22, 2021

2 How Much Does a 10-Year Term Life Insurance Policy Cost?, Quotacy, Jan 4, 2021

Life insurance is subject to underwriting and approval of the application and will incur monthly policy charges.

In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not protect the value of the variable investment options, which are subject to market risk.

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with their accounting or tax professionals for guidance regarding your specific financial situation.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL52