Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Executive Summary

Retirement loneliness is not only a social issue but also an economic burden that impacts healthcare costs, social care, productivity, insurance, and social welfare systems. Addressing this issue through effective policy changes can mitigate these economic costs and improve the quality of life for retirees.

Author: Qi Sun Ph.D., CFP®

BACKGROUND

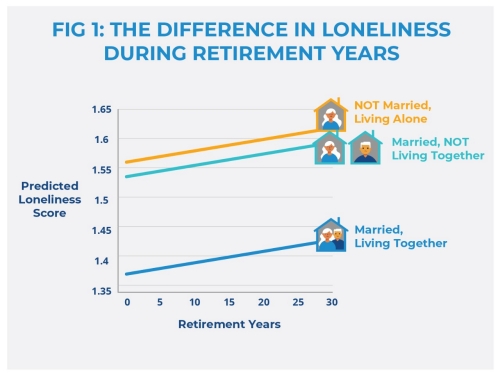

- Scope of the Issue: Loneliness is not a problem solely associated with older adults. In fact, past studies have found that the relationship between age and loneliness follows a U-shaped curve, with the highest levels of loneliness reported during the teenage years and later stages of life. This unique relationship means that loneliness is more prevalent among retirees, leading to significant health and financial issues. Additionally, decreasing marriage rates among older Americans contribute significantly to loneliness. According to a report from the U.S. Census Bureau, among those aged 85 and older, 60% of men are married compared to only 17% of women. Figure 11 clearly shows that being single and living alone exacerbates loneliness the longer individuals remain in retirement.

- Lack of Research: The majority of existing loneliness research has been conducted in the UK and EU countries. As a result, the economic impact of loneliness in the U.S. is limited. Differences in the public health care system and the retirement systems are too dissimilar to draw comparative conclusions.

- Existing Interventions to Reduce Loneliness: Previous research has suggested various interventions to address the issue of loneliness. These include, but are not limited to:

- Providing high-quality training to facilitators who can help older adults make use of community resources2.

- Addressing maladaptive thinking patterns3.

- Conducting group interventions with focus groups based on participants’ background characteristics4.

However, it is difficult to identify the effectiveness of interventions due to the challenge of conducting randomized trials. Furthermore, without a quantified evaluation methodology, it is also difficult to determine the cost-effectiveness of these interventions. Consequently, there is a pressing need to enrich the existing body of research on loneliness, especially for the growing number of retirees. Raising public awareness and securing policy support are essential steps in addressing the issue of loneliness. By highlighting the significant impact of loneliness and advocating for evidence-based policies, we can create a supportive environment for our aging society. This will help ensure that older adults can enjoy a happier and more fulfilling retirement life.

WHY DOES LONELINESS CAUSE PROBLEMS?

Researchers have explained the mechanism by which loneliness causes negative consequences across various areas. According to the loneliness model5, perceived social isolation leads to hyper-vigilance for social threats and negative cognitive biases. This, in turn, diminishes self-regulation capability and causes psychological dysfunction. Both factors contribute to adverse changes in health behaviors and bodily functions. What has research discovered about the economics of loneliness?

1. Costs Associated with Unhealthy Lifestyle:

- Diminished self-regulation caused by loneliness is directly reflected in unhealthy lifestyle choices. One study found that, on average, a one-unit increase in loneliness is associated with a 10% reduction in the odds of engaging in physical activities across all intensity levels, as well as an increase of three cigarettes smoked per day. This increased smoking habit, in turn, displaces other major household expenditures, such as housing and healthcare products, while simultaneously increasing alcohol spending6. These changes further deteriorate the financial and physical health of older Americans.

2. Costs Associated with Increased Healthcare Utilization:

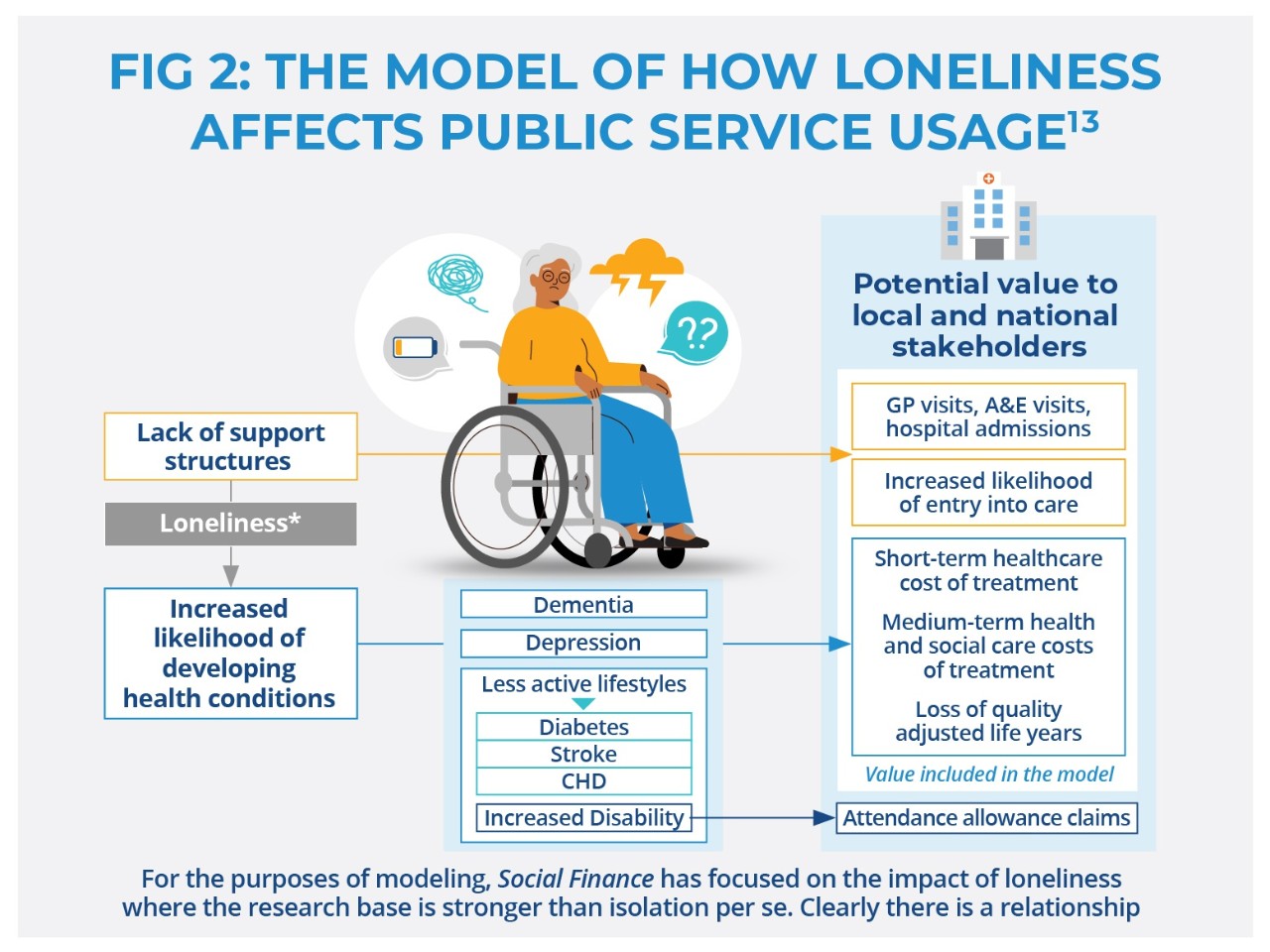

How loneliness increases health care utilization is mainly through the onset of new health problems and the need for social contact.

- Studies7,8 have found that loneliness and social isolation increase the risk of developing prevalent disabilities and chronic diseases. In fact, individuals with multiple chronic conditions are up to 50% more likely to face out-of-pocket medical expenses. These expenses can amount to as much as 80% of their social security retirement paycheck9.

- Chronic loneliness seems to have had a positive and significant effect on doctor visits and many of those doctor visits are for social connection support rather than solely medical treatment.

- Social isolation increases the usage of nursing homes, with Medicare spending an estimated $1,643 more annually on objectively isolated beneficiaries compared to those with greater social connections10. However, the same study noted that subjective feelings of loneliness create a barrier for individuals to utilize healthcare services. This reluctance to seek appropriate treatment can lead to temporary healthcare cost reductions but ultimately results in more significant long-term healthcare expenses due to untreated conditions.

3. Cost Associated with Productivity loss:

Another indirect economic cost associated with loneliness is the reduced productivity of caregivers who provide care for family members with chronic loneliness and health issues.

- In 2015, 18.2% of the U.S. adult population, or 43.5 million Americans, provided unpaid care to an adult relative, with the majority (34.2 million) of this care being delivered to individuals aged 50 or older11.

- Providing care for a family member significantly reduces job performance for employed caregivers. The average cost of lost compensation due to caregiving-related absenteeism and presenteeism was $126.27 and $338.00 per employee over a one-month period, respectively. This translates to annual losses of $1,515 and $4,056 per employee12.

CONCLUSION

Loneliness not only affects individuals’ mental and physical health but also imposes significant economic costs on healthcare systems, social care services, and overall productivity. Effective interventions and evidence-based policies can help create a supportive environment for older adults, ensuring a happier and more fulfilling retirement life. By taking comprehensive and coordinated actions now, we can address the pervasive issue of retirement loneliness and its associated economic impacts. This approach will foster a more inclusive, supportive, and economically resilient society, benefiting individuals and communities alike. Those efforts will not only improve individual well-being but also strengthen the economic and social fabric of society, leading to a brighter and more sustainable future for all.

READ MORE

SOURCES

1 Figure 1 is estimated by the author based on data from the 2006-2020 Health and Retirement Study. The results represent the marginal effects of a fixed-effects model, controlling for covariates such as activities of daily living (ADLs), depression scores, and log non-housing net worth.

2 Findlay, R. A. (2003). Interventions to reduce social isolation amongst older people: where is the evidence?. Ageing & Society, 23(5), 647-658.

3 Masi, C. M., Chen, H. Y., Hawkley, L. C., & Cacioppo, J. T. (2011). A meta-analysis of interventions to reduce loneliness. Personality and social psychology review, 15(3), 219-266.

4 Centre for Policy on Ageing. Rapid review: Loneliness—Evidence of the effectiveness of interventions. 2014. http://www.cpa.org.uk/information/reviews/CPA-Rapid-Review-Loneliness.pdf.

5 Hawkley, L. C., & Cacioppo, J. T. (2010). Loneliness matters: A theoretical and empirical review of consequences and mechanisms. Annals of behavioral medicine, 40(2), 218-227.

6 Busch, S. H., Jofre-Bonet, M., Falba, T. A., & Sindelar, J. L. (2004). Burning a hole in the budget: tobacco spending and its crowd-out of other goods. Applied health economics and health policy, 3, 263-272.

7 Crowe, C. L., Domingue, B. W., Graf, G. H., Keyes, K. M., Kwon, D., & Belsky, D. W. (2021). Associations of loneliness and social isolation with health span and life span in the US Health and Retirement Study. The Journals of Gerontology: Series A, 76(11), 1997-2006.

8 Theeke, L. A. (2010). Sociodemographic and health-related risks for loneliness and outcome differences by loneliness status in a sample of US older adults. Research in gerontological nursing, 3(2), 113-125.

9 Author’s upcoming article, Hidden Hurdle to The Golden Age: The Financial Impact of Chronic Disease on Older Americans

10 Shaw, J. G., Farid, M., Noel-Miller, C., Joseph, N., Houser, A., Asch, S. M., ... & Flowers, L. (2017). Social isolation and Medicare spending: Among older adults, objective isolation increases expenditures while loneliness does not. Journal of aging and health, 29(7), 1119-1143.

11 Schulz, R., Beach, S. R., Czaja, S. J., Martire, L. M., & Monin, J. K. (2020). Family caregiving for older adults. Annual review of psychology, 71(1), 635-659.

12 Fakeye, M. B. K., Samuel, L. J., Drabo, E. F., Bandeen-Roche, K., & Wolff, J. L. (2023). Caregiving-related work productivity loss among employed family and other unpaid caregivers of older adults. Value in Health, 26(5), 712-720.

13 Figure 2: Investing to tackle loneliness: A discussion paper: https://www.socialfinance.org.uk/assets/documents/investing_to_tackle_loneliness.pdf

Pacific Life, its affiliates, its distributors, and respective representatives do not provide tax, accounting, or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products.

Pacific Life, its affiliates, its distributors, and respective representatives do not provide any employer-sponsored qualified plan administrative services or impartial advice about investments and do not act in a fiduciary capacity for any plan.

Pacific Life refers to Pacific Life Insurance Company and its subsidiary Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company and in all states by Pacific Life & Annuity Company.

Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

DCLI0143_0724

PL81