Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Market volatility may have you considering making changes to your long-term investment strategy. Here’s why you should resist the urge.

When faced with an unsettled market, you may feel tempted to take quick action—like overhauling your investment strategy or getting out of the market altogether. However, staying the course will allow you to take advantage of the historically inevitable recovery that follows a downturn—ultimately bringing you closer to reaching your long-term goals.

While market fluctuations and drops can be nerve-racking, it’s important to keep in mind that fluctuations are normal. Some experts say the big gains investors have seen in recent years were due for a correction.

While that fact may not make the recent downturn any less painful, you can take comfort in knowing that historically, markets do recover. Ten years after the S&P 500 Index hit its Great Recession–era bottom in March 2009, it delivered a 10-year annualized return of 17.8 percent. And the Dow Jones industrial average recovered all of its steep Great Recession–related losses in just 5 ½ years. Investors who were scared out of the market by the volatility during the Great Recession missed out on the rebound.

Financial experts say that for those with decades until retirement, now is the time to stick with your plan and focus on the fundamentals. That includes making sure your asset allocations are aligned with your risk tolerance and time horizon.

Ideally, investors who are closer to retirement would have been less exposed to the stock market volatility, given the short time horizon, but they still may have taken a hit. There are strategies to help them overcome the losses. People just approaching retirement have three choices: to live on less in retirement, save more, or work longer.

Delaying retirement could allow you to replenish retirement savings and continue to take advantage of any matching funds from your employers. Or you can consider a second-act career that could supplement a smaller-than-anticipated nest egg. The recently passed Coronavirus Aid, Relief, and Economic Security Act (CARES Act) has suspended the required minimum distributions (RMD) for 2020, allowing those age 72 and older to keep their money in retirement accounts where it could potentially recoup losses over the next year. 1

CARES could affect your retirement strategy in other ways, too. The act raised the eligible loan amounts taken from 401(k)s and other defined benefit plans from $50,000 to $100,000 between now and September 23, 2020. It grants those in the five-year payback window for previous 401(k) loans an extra year to pay back what they borrowed. And it provides an exception for special coronavirus-related distributions, allowing those affected by the pandemic to take withdrawals of up to $100,000 from a retirement account, including IRAs, without the typical 10% penalty for those under age 59½. Navigating CARES Act eligibility conditions and options may require assistance from a financial professional, but its provisions could help you weather this turbulent season. If you’re decades from retirement or just a few years away, look to a financial professional to help you make decisions about the current market and keep you on track for the future.

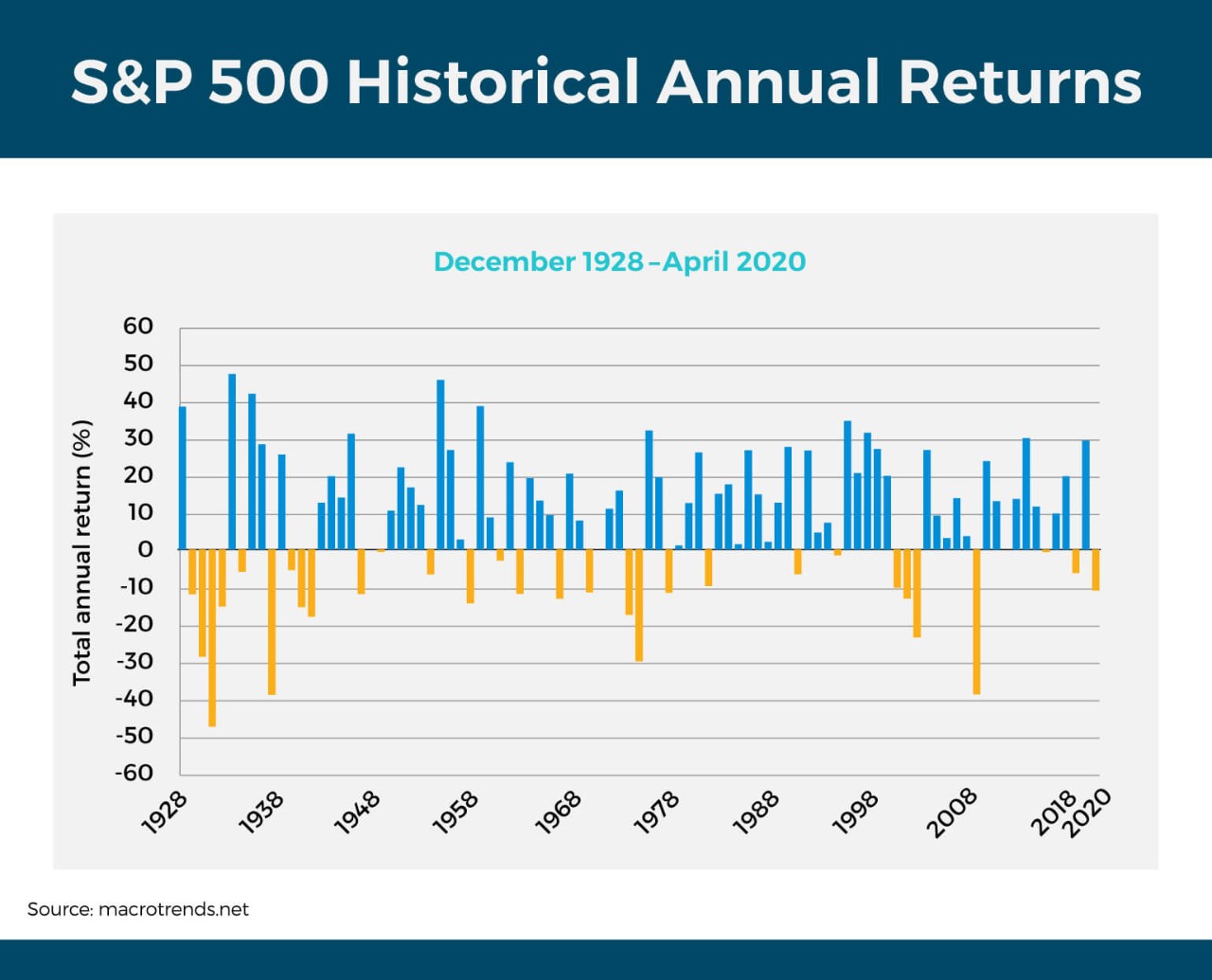

Historically Markets Recover: The S&P 500 index is a benchmark of U.S. stock market performance. These historical returns show that downturns have always been followed by a recovery.

1 The CARES Act also allows 2019 taxpayers, who were required to take the RMD at age 70.5, not to take it, if they had not acted on the requirement by the April 1, 2020, deadline.

READ MORE

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with your accounting or tax professional for guidance regarding your specific financial situation.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL49