Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

You’ve worked hard to build your retirement savings. Now, make sure your money lasts by considering strategies to lower taxes.

As you get closer to retirement, forecast your retirement spending and look at your marginal tax rate compared to your effective tax rate1. As retirement nears, you’ll have a better idea of what your taxes will be—and you can work with a financial professional and tax advisor to make any moves that may reduce your tax burden. In the meantime, here’s an overview of tactics to consider.

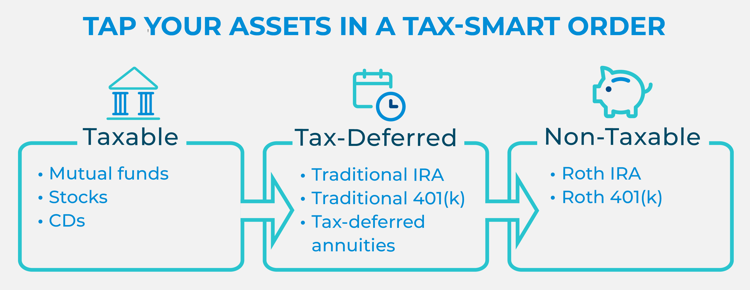

Categorize assets by taxable, tax-deferred, and non-taxable investment accounts and strategically tap them.

Traditional advice from tax advisors has suggested tapping accounts in this order:

- Taxable: First, tap brokerage accounts, with the goal being to let tax-deferred and tax-free retirement accounts continue to enjoy potential grow over time2,3.

- Tax-deferred: Next, tap tax-deferred vehicles such as IRAs. 401(k)s or tax-deferred annuities. For IRAs and 401(k)s, tax breaks occur up front, as contributions reduce taxable income and allow the money to potentially grow tax-free5. A tax-deferred annuity also allows your premium to potentially grow tax tree over time6. Plus, they have no contribution limit, in contrast to IRAs and 401(k)s7.

- Non-taxable: Finally, enjoy the tax-free benefit of withdrawals from any Roth IRAs or Roth 401(k)s you established2,3,4. It’s especially helpful to use Roth withdrawals during years with a higher tax burden, perhaps a year with big capital gains or an inheritance to off-set overall tax burden. Similarly, a cash value life insurance policy can allow comfortable retirees to borrow or withdraw funds tax-free from contributions they’ve made to the policy8, enjoying those funds without touching any taxable earnings.

Sources: (1), (2), (3)

Sources: (1), (2), (3)

While this order represents conventional wisdom about tapping retirement accounts, financial institutions also recommend retirees consider a proportional withdrawal strategy—tapping each type of retirement account annually based on how much each represents of their overall retirement savings. Rather than waiting to tap tax-deferred accounts, for instance, they could tap both taxable and tax-deferred funds to meet annual living expenses. The advantages? The strategy may spread out the tax burden more evenly over the years and also could result in tax savings2,3,4.

Lower taxes by reducing expenses. Pay off your mortgage and any other outstanding debt9, and if you’re looking to move, consider which regions might have lower retirement costs. US. News and World Report compiles a list of “Best Places to Retire in 2020-2021” based on factors that include the local residents’ happiness, housing affordability, quality of health care, and tax rates10—putting Sarasota, Florida, at the top of the list thanks, in part, to its tax benefits for retirees11. Florida is a state with no income tax, as shown in this tax-rates.org map12. The map shows income tax rates for all 50 states, including states with the highest state income tax rates, such as Maine (6.57%) and California (7.75%). For instance, your dream of retiring to Hawaii comes with state tax rates at 7.02%, and if you want to move to Minnesota, factor a 7.46% state tax rate into your retirement spending plan12.

Reposition assets by moving them from taxable accounts to tax-deferred vehicles, such as cash value life insurance or nonqualified annuities. Such moves may give your premium dollars time to potentially grow tax free. You can even use savings or money from brokerage accounts to purchase a tax-deferred annuity or cash value life policy. And some retirees with high net worth might even discover that a combination of a tax-deferred annuity and a cash value life policy can produce a very advantageous tax benefit to your portfolio13,14.

Leading up to retirement, you also might consider a Roth conversion, moving funds from a traditional IRA to a Roth IRA. During the conversion year, you’ll have to pay taxes on your original tax-deductible contributions and on any tax-deferred earnings, but it helps that you’ll still be working and earning income. Later, in retirement, you’ll enjoy tax-free withdrawals15.

Guard against bumping into the next highest tax bracket, so you don’t pay higher premiums for Medicare Parts B and D and certain taxes. It’s a given that higher income Americans will pay more in taxes related to Social Security earnings because that tax threshold is relatively low1. But there are other premiums and taxes that you can curb with a little foresight. Work with your financial planner to make financial moves that can keep you at a lower income level to pay the lesser amounts.

- Medicare Parts B and D Premiums. Those with higher income levels pay more every month for these premiums. For instance, in 2021, the highest earners will pay $504.90 monthly for Part B premiums alone16.

- Net Investment Income Tax. This 3.8% tax is levied on income from capital gains or dividends, from rental income and other investments if you meet certain income thresholds. Stay under those thresholds and you avoid that tax17.

- Alternative Minimum Tax. High-income earners must calculate their AMT tax rates along with standard tax rates and pay the higher of the two18.

- Capital Gains. The rate for higher earners is either 15% or 20%, based on income level19.

Relying on certain types of annuities to help lower your taxable rate in retirement. After maxing out 401(k)s, making IRA contributions, and perhaps investing in other brokerage accounts, annuities deserve consideration from soon-to-be retirees looking to defer tax, enjoy tax-free growth and ultimately reduce taxes. As discussed above, tax-deferred annuities only require you to pay tax on the interest earned and not on the original investment6. Called the exclusion ratio, this feature of annuities can allow them to play a significant role in some retirees’ overall retirement plan. You also can consider purchasing a non-qualified immediate annuity—a category of annuities bought with an after-tax sum of money. Your premium will immediately become annuitized or divided over time into monthly payments. The tax advantage is that since you purchased it with post-tax dollars, only earnings will be subject to future taxation20.

Keep in mind that every situation differs, and a financial professional and tax advisor can help you make the most tax-advantaged moves as you build an income stream in retirement.

READ MORE

1 "Can I Lower My Income Tax Bill Now That I’m Retired?", Charles Schwab

2 "Five Do’s and Don’ts for Tax-Efficient Retirement Withdrawals", Charles Schwab

3 "Tax-savvy withdrawals in retirement", Fidelity

4 "Paying Taxes Wisely: A Fresh Look at Tax-Efficient Withdrawal Strategies", Kiplinger

5 "Retirement Accounts You Should Consider", U.S. News and World Report

6 "How Annuities are Taxed", Kiplinger

7 "Ultimate guide to retirement What are the advantages of annuities?", CNN Money

8 "Tapping the Cash in Life Insurance", Kiplinger

9 "7 Ways to Minimize Income Tax in Retirement", U.S. News and World Report

10 "The Best Places to Retire in 2021", U.S. News and World Report

11 "Sarasota, Florida", U.S. News and World Report

12 "Income Tax Rates By State", Tax Rate.org

13 "How to Enhance Your Retirement Strategy with Cash Value Life Insurance", Pacific Life

14 "How Annuities Can Boost Your Retirement Savings", Pacific Life

15 "Roth IRA Conversions: What You Need to Know", Wall Street Journal

16 "Medicare Costs at a Glance", Medicare

17 "Questions and Answers on the Net Investment Income Tax", Internal Revenue Service

18 "Topic No. 556 Alternative Minimum Tax", Internal Revenue Service

19 "Topic No. 409 Capital Gains and Losses", Internal Revenue Service

20 "Exclusion Ratio", Investopedia

21 "How are Non-Qualified Variable Annuities Taxed?", Investopedia

The information above, including the results and explanations generated by the calculator, is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with their accounting or tax professionals for guidance regarding your specific financial situation.

Amounts withdrawn from retirement savings vehicles intended for retirement prior to age 59 1/2 may be subject to federal and/or state income taxes and an additional 10% federal penalty tax may apply.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL62