Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Creating a detailed succession plan is paramount for a smooth and profitable transition.

When you’ve dedicated decades to building your company, it can be difficult to imagine your life without it—not to mention the future of the business with another family member as the lead. In reality, everyone will transition out of their family business at some point, but those who fail to face this truth may risk creating unnecessary stress and incurring unforeseen expenses when it’s time to pass the business on.

Obstacles to Succession Planning

Handing over a family business can be an emotional process, so many owners do not broach the subject early enough to develop a comprehensive plan that ensures their financial and emotional safety. The reasons for procrastination differ: Some people find it challenging to place a monetary value on their life’s work. Others believe that younger family members are not capable of taking over, so they avoid the subject in an attempt to preserve the relationships—and their version of the business. Still others are unsure of how to begin the process or are uncomfortable with the possibility that a nonfamily successor may be the most appropriate choice.

The Risks of Not Having a Plan

Without proper planning, however, business owners risk paying too much in capital gains, income and estate taxes. In addition, they could be hurting the value of their company, which can affect both their profits and the status of the business once their successor takes over.

Five Key Points in Succession Planning

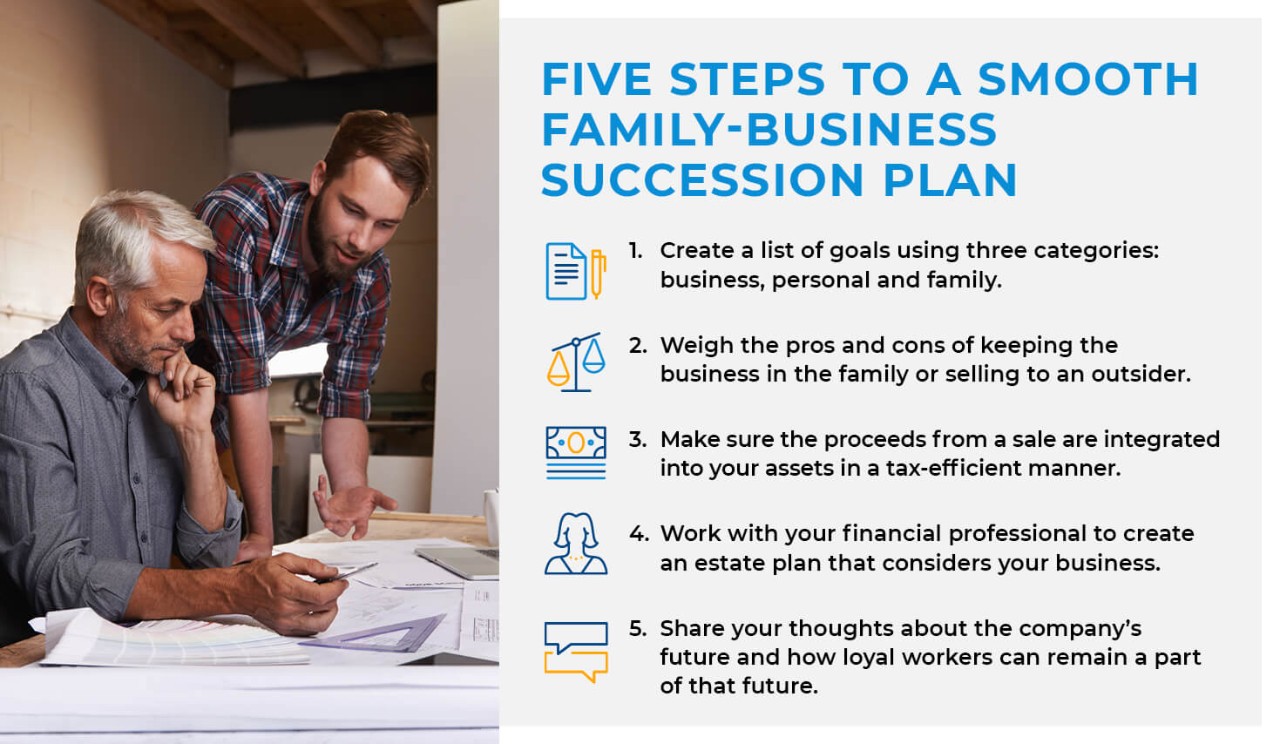

The key is to develop a detailed succession plan many years in advance—one that highlights your vision for both the future of the company and your needs in retirement. Partner with a financial professional*, preferably one who has experience with family business succession and personal wealth management, to discuss the following topics and optimize your plan. Here are five steps to consider:

1. Clarify your priorities. Create a list of your goals, separating them into three categories—business, personal and family—to ensure that you are addressing all the areas of your life that will be affected by the plan. Be as specific as possible and allow yourself to paint a picture of your ideal future, even if it seems far-fetched. Along the way, be sure to consider whether transferring the company to a family member will help meet your goals or if you may be able to demand a higher price by selling to an outsider.

2. Develop a plan for the sale. Your trusted business advisers can help you design a cohesive plan and facilitate communication with prospective successors so that you can move toward an agreement. Once you have the outlines of a plan, you’ll want to work with your attorney and accountant to nail down the specifics of transferring the business to its new owner, including the details of how payment will occur.

3. Protect and access the wealth you’ve built. Because your risk profile will change dramatically following the transfer of the business, seek to identify a secure place for your initial liquidity, such as an independent custodian. You want your money to be safe during the transition from being a business owner to a wealth owner. Your financial professional can then help you integrate these assets into your personal financial plan and run various scenarios to estimate what money you’ll have available to spend after taxes each year for the rest of your life.

4. Create a tax-efficient estate plan that considers your business. Guided by your succession plan, an estate plan can help structure the distribution of your assets to your heirs. Identify the beneficiaries for all of your assets, including your business, and gain an understanding of how state-specific tax laws will affect your assets. Federal tax laws on gifting have also changed, which may make large charitable donations more attractive from a tax perspective. If there are organizations you want to support, now is the time to designate them as beneficiaries.

5. Spend time on governance and transition details. Seek to leave your mark on the business if the new owner allows it and if you want to remain involved. Share your thoughts about the company's future and how longtime loyal workers can remain a part of that future.

Bottom line: If you own a business, you need a business succession plan. By protecting your assets and arranging for their distribution, you’re increasing your chances of a retirement you have control over. You’re also giving your family the tools they need to live out your legacy.

READ MORE

*In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

Pacific Life, its affiliates, their distributors and respective representatives do not provide tax, accounting or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA

PL15A