Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Claiming benefits when you are younger than your full retirement age can mean missing out on hundreds of dollars per month.

Many Americans rely on Social Security benefits as a significant source of income in retirement. However, not everyone understands the rules surrounding these benefits. As a result, they may claim their benefits at a time that’s less than ideal for their circumstances, ultimately shortchanging themselves in the process.

There’s no magic age for when you should begin claiming benefits—each person’s situation and needs are unique—but there are several factors to consider when optimizing Social Security benefits as part of your comprehensive retirement plan.

Full retirement age

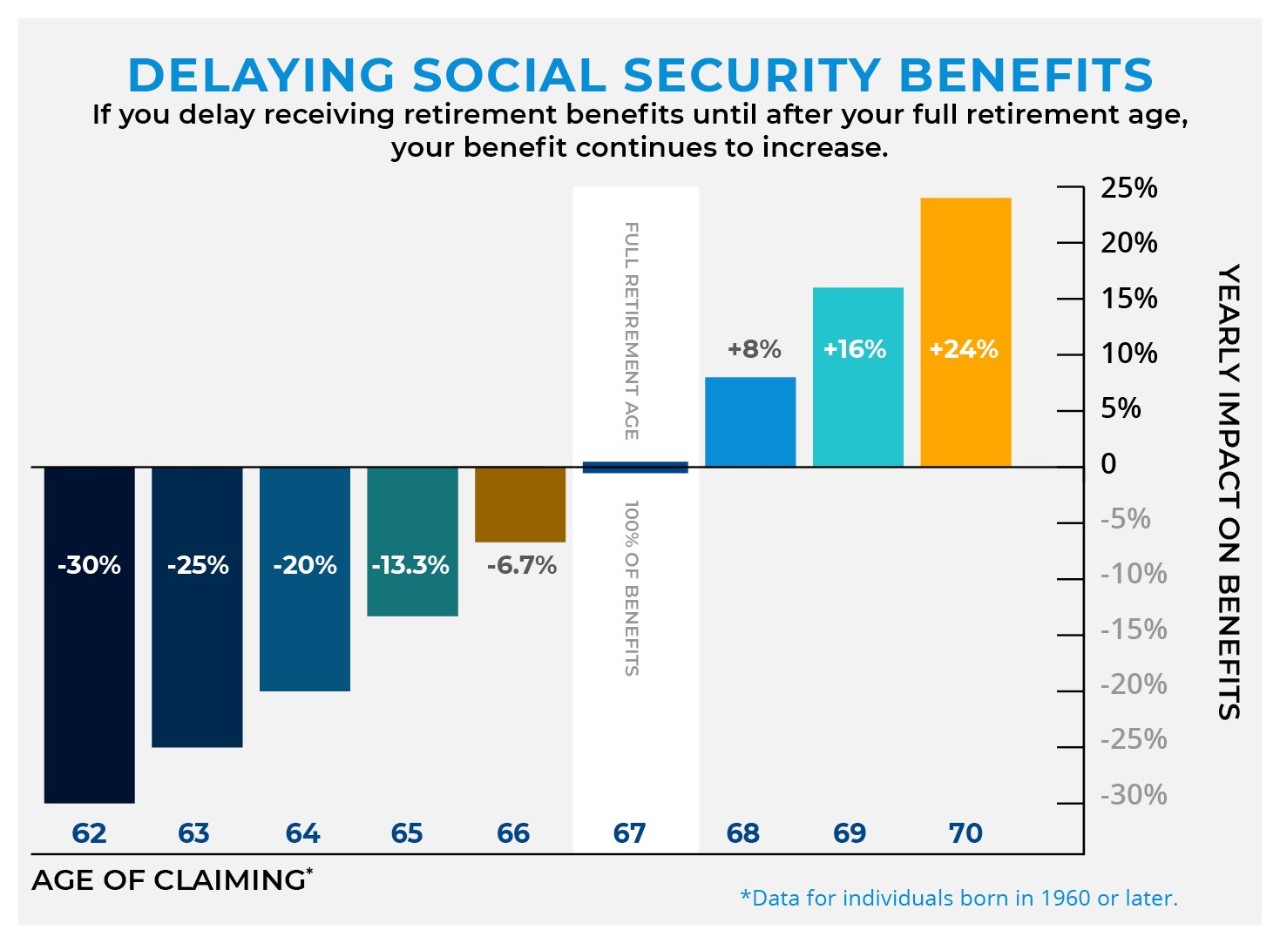

To begin strategizing about when to claim benefits, you’ll first need to determine your full retirement age (FRA) as indicated by the Social Security Administration. If you were born in 1960 or later, your FRA is 67. If you were born before 1960, your FRA falls between 65 and 66, depending on the specific year you were born. Although you’re allowed to start claiming Social Security benefits as early as age 62, you won’t receive full monthly benefits unless you wait until your FRA to claim them.

Claiming early can mean missing out on hundreds of dollars per month, which adds up if you decide to begin the process several years early.

Furthermore, if you delay Social Security benefits past your FRA, your benefits will increase by 8 percent each year until age 70. For example, if your FRA is 67 and you wait until 70 to claim Social Security benefits, your monthly benefit increases by 24 percent. Some retirees are tempted to claim their benefits early and reinvest them; however, the investments may not produce returns large enough to beat the guaranteed 8 percent annual growth in delaying Social Security benefits.

Claiming early

Because of these rules, it may seem like a no-brainer to delay retirement benefits, but doing so is not a realistic option for everyone. Your health and longevity are major factors in determining how much money you’ll need in retirement. If you are treating a chronic condition and have a shorter life expectancy than average, it may be wise to choose the support of early Social Security benefit payments. Likewise, if you simply need the income, Social Security benefits can be a saving grace.

On the other hand, if you’re in good health and expect to live well into your 80s, it may be wise to increase your benefit by delaying your claim as long as possible (up to age 70) to receive the maximum benefit payment amount. If you want to delay your Social Security benefits but do not have sufficient sources of income, you may consider tapping into retirement accounts, such as 401(k) plans and IRAs, to help bridge the income gap before reaching your FRA.

Coordinating with your spouse

If you’re married, your Social Security benefits strategy should also take your spouse’s benefits into consideration. For instance, you may decide that the lower-earning spouse should claim benefits at full retirement age for cash flow reasons, while the higher-earning spouse’s benefits grow until age 70.

Ultimately, to optimize Social Security benefits you need to find the sweet spot—the point at which the higher monthly benefits you’d receive by waiting to claim exceed the amount of money you’ll miss by not claiming early. For many people, that means delaying claiming Social Security as long as possible. Consult your financial professional for assistance in determining what retirement income options can support your unique circumstances.

READ MORE

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with your accounting or tax professional for guidance regarding your specific financial situation.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL11A