Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Life insurance can help maximize wealth transfer for unmarried couples.

The number of adults living with an unmarried partner has increased nearly 30% in the last decade1. However, estate-planning practices haven’t necessarily kept pace. In fact, it’s particularly important for unmarried couples—including same-sex unmarried couples and cohabitating couples—to organize their assets strategically via the estate-planning process, as they face unique financial challenges that are not protected by the structure of marriage.

Marriage provides individuals with certain legal rights, including the right to receive spousal Social Security benefits and inherit property automatically, as well as the power to make healthcare and financial decisions on behalf of their spouses. In addition, many state inheritance laws and standard estate-planning practices prioritize surviving spouses and biological children.

But this can cause problems for unmarried couples, as the surviving partner may not be recognized as an heir—by law or by the deceased partner’s family. This scenario can cause conflict and financial distress at an already difficult time.

The benefits of life insurance

Life insurance* policies offer a potential solution to these challenges—and they can be more effective when combined with a trust. However, establishing insurable interest is a prerequisite for this strategy, and insurable interest laws vary by state. The unmarried couple may have to present evidence such as jointly owned assets, business interests and wills to prove insurable interest in each other.

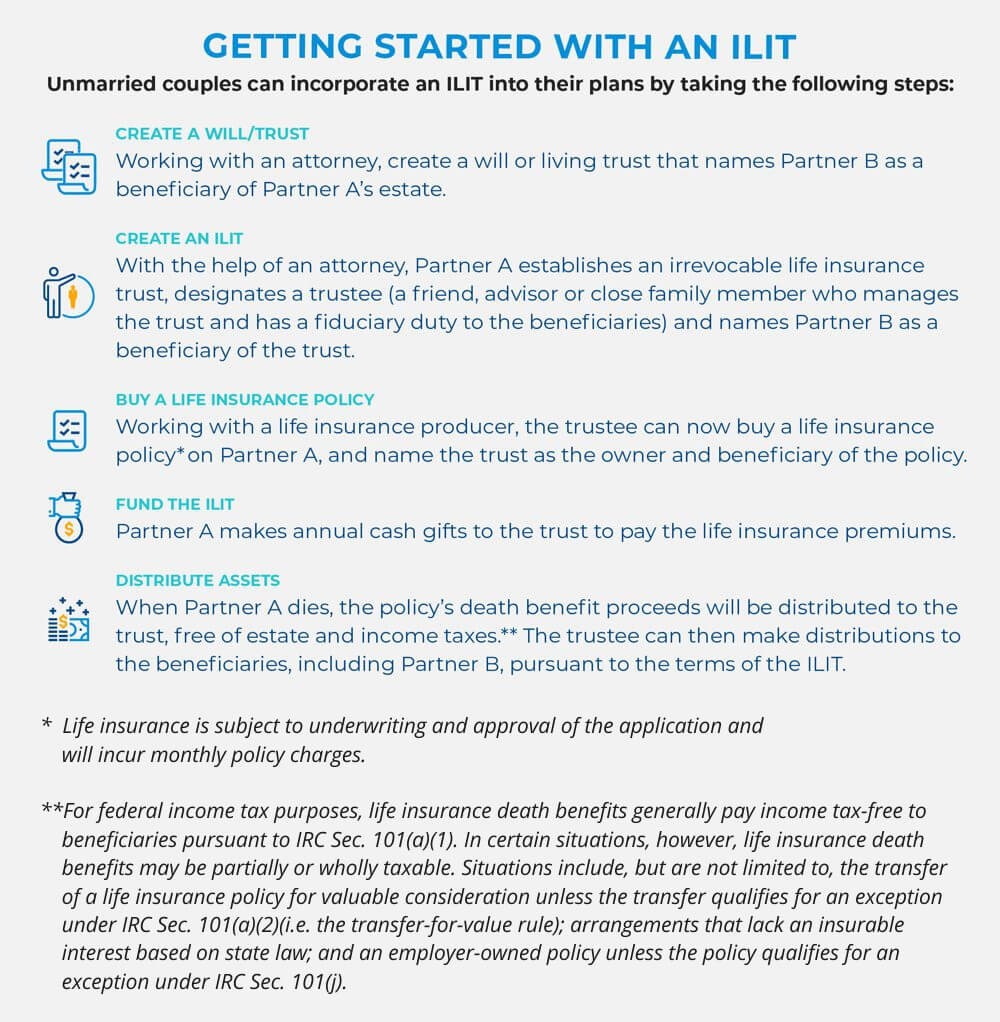

Once insurable interest is established, one of the unmarried partners can establish an irrevocable life insurance trust (ILIT). Since an ILIT is designed to own a life insurance policy and designate specific beneficiaries, such as a partner, this is a way for an unmarried partner to receive life insurance death benefit proceeds from the ILIT, upon the death of the insured partner.

The terms of the ILIT designate the intended beneficiaries of the ILIT's assets and dictate when and under what circumstances the beneficiaries are to receive distributions from it. This structure bypasses any confusion about who is to receive the assets. This feature can prevent conflict between the surviving partner and other family members, who may otherwise disagree on how the deceased partner’s assets are to be distributed. An ILIT may also give surviving partners the opportunity to receive funds otherwise overlooked by typical inheritance laws.

Although unmarried couples are not eligible to transfer assets to each other tax-free in the same way that married couples do through traditional marital deductions, an ILIT can be funded with annual cash gifts to pay the policy premiums. If the gifts to the ILIT qualify for the annual exclusion and/or the lifetime gift tax exemption amount, the gifts should not be subject to gift tax.2,3 Assuming the ILIT is funded and structured properly, the trust receives the life insurance death benefit proceeds free of estate and income taxes upon the insured’s death.4 If the deceased partner’s estate is large, those proceeds could potentially be used to help reduce the estate tax bill.

READ MORE

1 Rising Share of U.S. Adults Are Living Without a Spouse or Partner, https://www.pewresearch.org/social-trends/2021/10/05/rising-share-of-u-s-adults-are-living-without-a-spouse-or-partner/ (accessed 9/13/2022)

2 As of January 1, 2022, the annual gift tax exclusion is $16,000 per donee (indexed for inflation).

3 According to the Tax Cuts and Jobs Act of 2017, the federal estate, gift and generation-skipping transfer (GST) tax exemption amounts are all $10,000,000 per person (indexed for inflation effective for tax years after 2011); the maximum estate, gift and GST tax rates are 40%. In 2026, the federal estate, gift and generation-skipping transfer (GST) tax exemption amounts are scheduled to revert to $5,000,000 per person (indexed for inflation for tax years after 2011).

4 For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2) (i.e., the “transfer-for-value rule”); arrangements that lack an insurable interest based on state law; and an employer-owned policy unless the policy qualifies for an exception under IRC Sec. 101(j).

The results and explanations generated by the calculator on this page may vary due to user input and assumptions. Pacific Life does not guarantee the accuracy of the calculations, results, explanations, nor applicability to your specific situation. We recommend that you use this calculator as a guideline only and ultimately seek the guidance of an experienced professional. CalcXML, the provider of this information and interactive calculator, is an independent third-party and is not affiliated with Pacific Life.

Pacific Life, its affiliates, their distributors and respective representatives do not provide tax, accounting or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL30A