Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

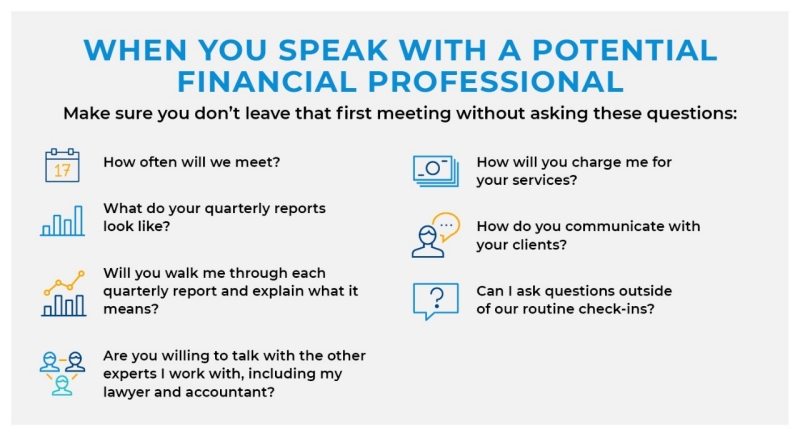

When searching for the right financial professional for you, start with these 7 questions.

According to a 2021 study by The Harris Poll1, 53 percent of Americans say one of their top goals for the year was going to be related to their finances. As American society faces an undetermined future, financial professionals have a new opportunity to boost services for existing clients and prove their value to financially underserved consumers. Yet financial professionals are not one size fits all. They have a wide range of investment philosophies, communication styles and ways of charging clients. This diversity can make it difficult to choose a financial professional who meets your needs. But it doesn’t have to. You just need to know what to look for, and the right questions to ask.

Are they qualified?

The most common professional designations you’re likely to encounter in your search are CFP®2 (Certified Financial Planner™) and CFA®3 (Chartered Financial Analyst®). A CFP’s skill set is geared toward total wealth management, including debt consolidation, portfolio management, retirement savings and estate planning. A CFA®’s skill set is more specifically focused on managing financial portfolios for individuals and businesses. A financial professional must also be a state-licensed life insurance producer and appointed to sell life insurance products.

If you’re considering working with a financial professional who promotes variable products, like variable annuities, variable life insurance and mutual funds, it’s a good idea to check their employment history and determine whether there have been investment-related, consumer-initiated complaints or arbitrations against them. (Bear in mind that not all complaints or arbitrations are reportable.) Any financial professional registered with the Financial Industry Regulatory Authority can be checked through BrokerCheck.

Are they a good fit for you?

Most financial professionals you research will do a fine job assisting you with your assets. But a great financial professional will take time to truly dig into your financial goals and help you build a plan to pursue them. Look for a financial professional who makes you feel comfortable and who will really learn the complexities of your financial situation.

Also consider whether the financial professional’s communication style is a good match for you. Do they explain things in a way you comprehend? Ask to see samples of the quarterly reports they send to clients. These documents may tell you a lot about how the financial professional communicates with clients.

For instance, some financial professionals may not send much more than the amount of your total assets and how much you’ve earned since the last quarter. Others may send detailed reports with charts describing your asset mix, their rationale and an overall assessment. Whatever type of report they offer, it should be one that you understand and that contains the type of information you’re interested in.

And about that fine print …

Before you begin working with a financial professional, make sure you know all the details about how they get paid. Fee-based financial professionals will usually charge a percentage of the assets they oversee for you.

Commission-based financial professionals will not charge you a fee. For life insurance products without variable investment options, their commissions are paid by the companies issuing the products they sell, so there’s no out-of-pocket cost to you.

For products with variable investement options, commissions to the financial professional may have to be paid by the client through the underlying investments in addition to the commission paid by the insurance company.

The bottom line: Ask questions

When you meet a financial professional, be open about your questions and concerns. Someone who answers your questions clearly and to your satisfaction may be just the right fit to help you reach your financial goals.

READ MORE

1 "MDRT study reveals Americans’ financial priorities after a year of the pandemic and recession", retrieved Oct. 23, 2021

2 A CFP® designation (Certified Financial Planner™) is a professional certification for financial planners that signifies expertise in financial planning and a commitment to high ethical standards, including acting as a fiduciary for clients. To earn the designation, candidates must meet stringent requirements for education, experience, and passing a comprehensive exam administered by the CFP Board, and they are required to complete continuing education and adhere to ethical guidelines to maintain their certification.

3 The CFA® (Chartered Financial Analyst®) Charter is a globally recognized designation that attests to success in a rigorous and comprehensive study program in the investment management and research industry and a commitment to ethical conduct. CFA Charterholders are held to a standard of loyalty, prudence, and care in all our interactions with their clients and must act for the benefit of their clients and place their clients’ interests above their own. They are bound to comply with any legally required fiduciary duty.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products.

Pacific Life refers to Pacific Life Insurance Company and its subsidiary Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company and in all states by Pacific Life & Annuity Company. Product/material availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Insurance products and their guarantees, including optional benefits, annuity payout rates, and any crediting rates, are backed by the financial strength and claims-paying ability of the issuing insurance company, but they do not protect the value of the variable investment options. Look to the strength of the insurance company with regard to such guarantees because these guarantees are not backed by the independent broker/dealers, insurance agencies, or their affiliates from which products are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability of the issuing company.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

| Investment and Insurance Products: Not a Deposit | Not insured by any Federal Government Agency | |

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

PL4D