Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

A well-designed charitable remainder trust can lower taxes and aid in financial planning.

For charitable investors, there’s more to making donations than simply selling stock and writing a check. If you want to maximize your giving, you need to consider the capital gains and other tax implications of the assets you donate. It’s also important to know how your philanthropy will fit into the bigger picture: What place does giving have in your overall estate plan? How will it influence your family members’ inheritance? And how can you make sure it won’t undermine your plans for retirement income and security?

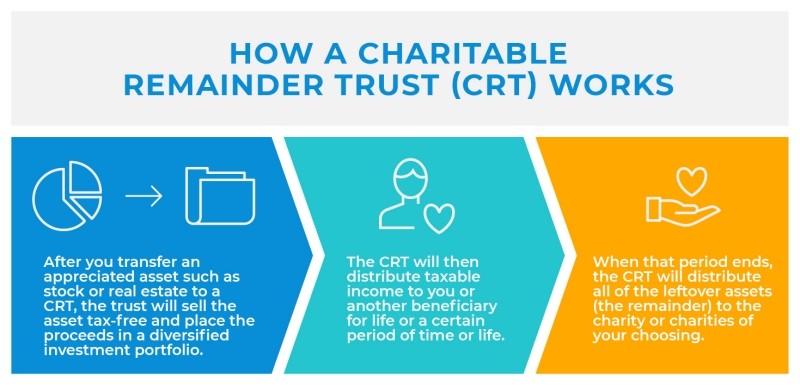

One option to make your charitable, tax and retirement strategies complement one another is to create a charitable remainder trust (CRT). When you transfer an appreciated asset, such as stock or real estate, to a CRT, the trust will sell the asset tax-free and place the proceeds in a diversified investment portfolio. From that pool of more liquid assets, the CRT will distribute taxable income to you or another beneficiary for a certain period of time. When that period ends, the CRT will distribute all of the remaining assets to the charity or charities of your choosing.

The structure of a CRT can deliver key benefits:

Favorable tax treatment

Typically, when you sell an appreciated asset that you’ve held outside of a qualified retirement account, you’ll owe a cut of your investment earnings to the government. But that’s not the case with a CRT. Since CRTs are tax-exempt entities, they can sell stock or other assets at a gain without triggering any capital gains taxes.

On creating a CRT, you may qualify for an income tax deduction up to the present value of the assets you’ve earmarked to go to charity once the CRT term is over. However, it’s important not to confuse this with your CRT’s distributions to the trust’s beneficiary in the meantime: The distributions the beneficiary receives are taxed as income. Note that you’ll only secure favorable tax treatment by distributing assets within some required ranges. For example, designate between 5 and 50 percent for payout to your income beneficiary and at least 10 percent for payout to your intended charity.

Boosted cash flow

When you transfer appreciated stock or real estate into a CRT, you are turning an illiquid asset into a stream of income. That extra source of revenue can support your near-term cash flow and budgeting needs. But bear in mind that since CRTs are a type of irrevocable trust, you are giving up direct control of those assets.

Enhanced lifetime cash-flow planning

Since CRTs are designed to distribute regular income to a beneficiary, they can serve as a crucial element in your long-term financial planning. Every CRT has a set term during which it distributes money to the income beneficiary (and after which it donates the remaining balance to charity). The creator of a CRT decides ahead of time whether the term will last for a certain number of years (up to 20) or for the rest of the beneficiary’s lifetime. With the lifetime option, a CRT can supplement Social Security benefits or an annuity as a source of steady long-term income for your retirement.

Legacy decision-making

A CRT gives you an opportunity to define the overall objectives of your estate. Do you want your charitable gifts to occur during your lifetime or as a component of your legacy? If the former, setting a shorter term for the trust to operate may be the better option. If primarily the latter, designing the CRT for lifetime income probably makes more sense, especially since the lifetime income can be used to purchase life insurance and leave a legacy to your heirs. In either case, you can use a CRT to formalize philanthropy as a key element of your estate plan.

CRTs are just one option for charitable investors who want to make their donated dollars go as far as possible. For instance, a charitable lead trust has an inverse structure: The regular distributions go to a charity for a set term, while the remaining balance goes to the named beneficiary. Your financial professional can help you explore other charitable trust options as part of a comprehensive, tax-aware financial plan that supports you, your family and the causes you care about.

READ MORE

The results and explanations generated by this calculator may vary due to user input and assumptions. Pacific Life does not guarantee the accuracy of the calculations, results, explanations, nor applicability to your specific situation. We recommend that you use this calculator as a guideline only and ultimately seek the guidance of an experienced professional. CalcXML, the provider of this information and interactive calculator, is an independent third-party and is not affiliated with Pacific Life.

The above is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with their accounting or tax professionals for guidance regarding your specific financial situation.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues. Insurance products and their guarantees, including optional benefits and any crediting rates, are backed by the financial strength and claims-paying ability of the issuing insurance company. Look to the strength of the life insurance company with regard to such guarantees as these guarantees are not backed by the broker-dealer, insurance agency or their affiliates from which products are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability of the life insurance company.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL3A