Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Qi Sun Ph.D., CFP | Financial iQ with Dr. Qi | March 2023

Key Takeaways

- People who are subject to behavioral bias often misjudge their retirement-living standards, resulting in disappointment about their retirement.

- The percentage of retirees receiving regular paychecks from pension plans has decreased by 45%, while many new retirees will increasingly rely on social security income as their only source of guaranteed lifetime income.

- The change in retirement income structure makes it harder for pre-retirees to have a clear picture of their future retirement life, and they become increasingly worried about future income.

I Didn’t Sign Up for This: Don’t Let High Expectations Ruin a Perfectly Good Retirement

In the first issue of Financial iQ, "Happiness in Retirement? Here’s What the Research Says," I talked about how retirement satisfaction fluctuates throughout retirement and how forming realistic expectations about retirement life will improve retirement outcomes. As a follow-up, in this issue I’ll explore why there’s a deviation between retirees' expectations and the reality of retirement life.

Behavioral Bias and Affective Forecasting

When studying retirement decisions, Wilson and Gilbert (2003) found that most individuals cannot forecast their future accurately.¹ They explained that this inaccurate prediction is mainly because of the imprecise mental simulations of future events, which is called affective forecasting. Affective forecasting often leads individuals to imagine that an event would be much better or worse than it turns out to be. I found interesting evidence to support this potential behavioral bias on retirement expectations.

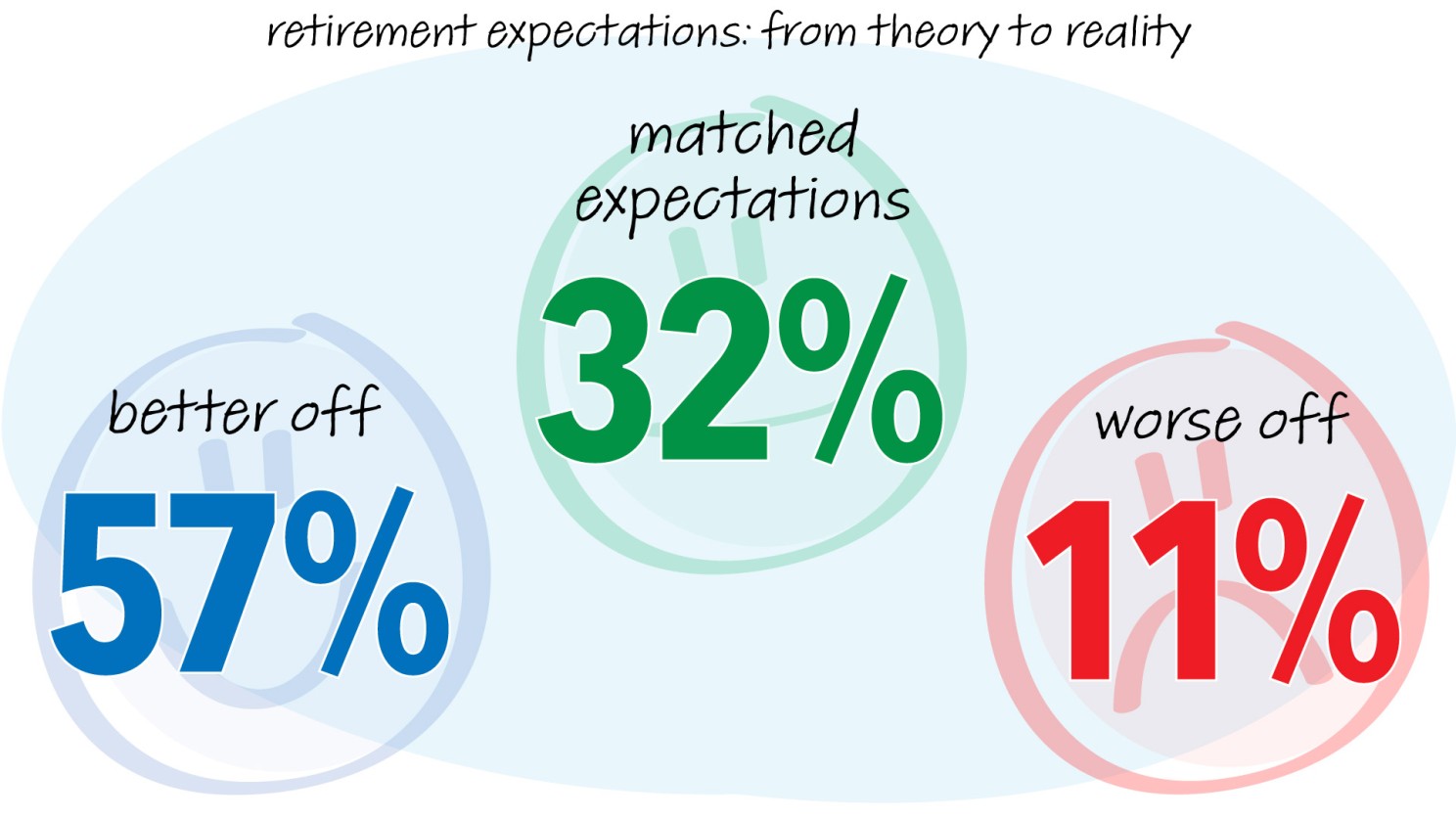

A national survey—Health and Retirement Survey (HRS), which began in 1992 and continues to the present day—asks pre-retirees whether they would expect their retirement-living standard to increase, stay the same or decrease during retirement. The survey asks respondents how they felt about their retirement life soon after retirement. Figure 1 displays the comparison between pre-retirement expectations to post-retirement feelings.

[Figure 1] Findings based on our internal analysis of data from the 2018 Health and Retirement Study show that unrealistically high expectations of retirement life can lead to a big letdown in retirement satisfaction.

[Figure 1] Findings based on our internal analysis of data from the 2018 Health and Retirement Study show that unrealistically high expectations of retirement life can lead to a big letdown in retirement satisfaction.

Of respondents who entered retirement between 1994 and 2018, only around 32% of them reported feelings that aligned with their pre-retirement expectations, and the remaining 66% did not.² What caught my attention is that about 10% of the retirees felt their retirement life was worse than expected. This situation worsens for those who recently entered retirement.

As we concluded in the first issue of this newsletter, retirement satisfaction is not a reflection of the retiree's absolute wealth. Instead, the happiness level often depends on the contrast between the retiree’s current retirement life to their pre-retirement life. This is known as the reference point effect. We also discussed how a beneficial “reference point” can help retirees to maintain a happy retirement life. Based on the HRS data, we can clearly see the reference point effect on people's retirement satisfaction. For example, only 14% of those retirees who felt worse off were very satisfied with their retirement life. In comparison, 75% of retirees who felt better off were satisfied with their retirement life.³

Retirement Income: A Generational Shift

Research confirms that annuitizing a portion of a retirement savings portfolio into a steady income stream establishes a realistic expectation of retirement income.⁴ In addition, doing so also enables a realistic expectation of the standard of living one can afford and mitigates the "reference point" effect. Unfortunately, for Baby Boomers and Generation X, obtaining this steady retirement income stream will be more challenging.

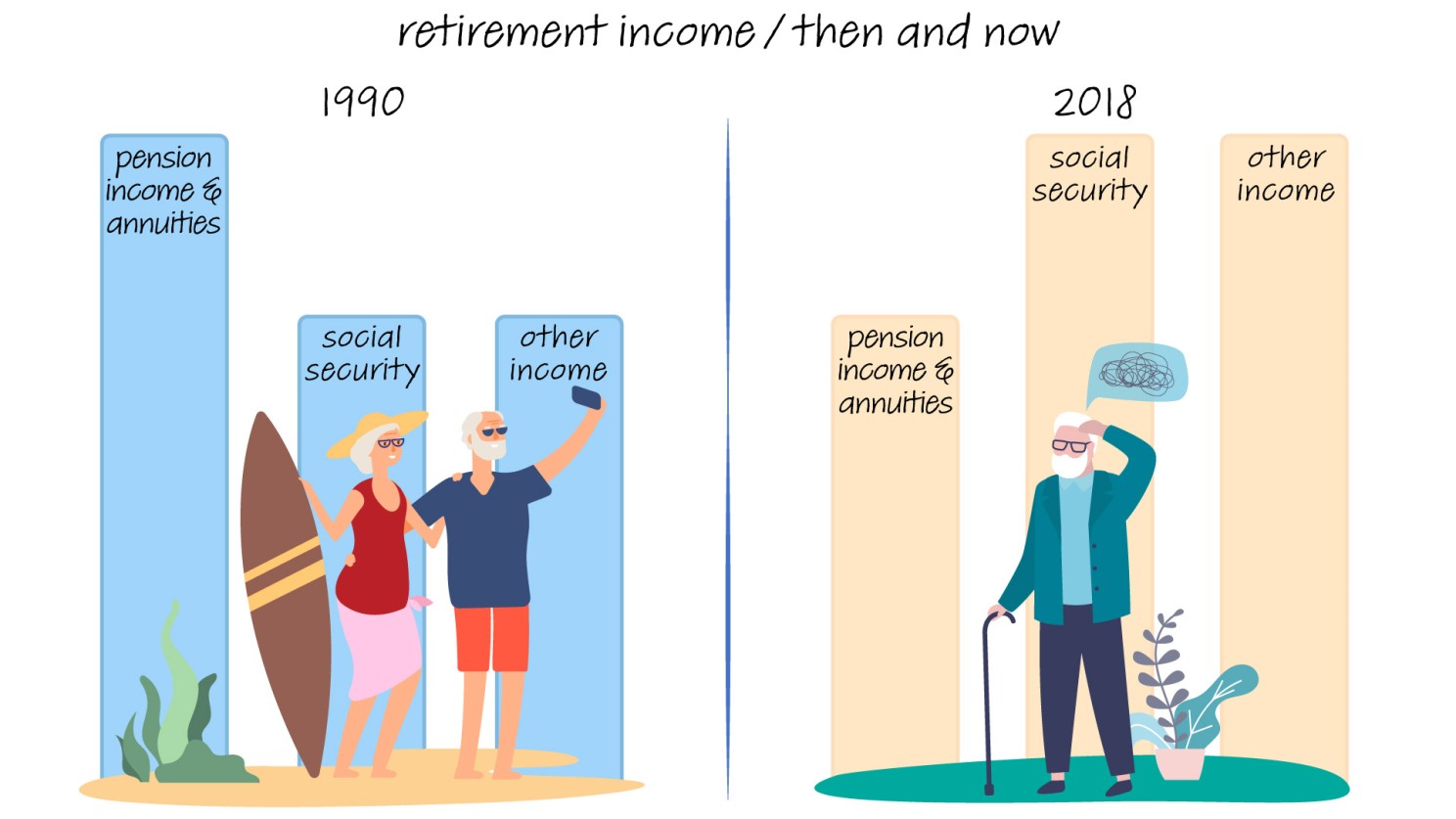

Because many employer-sponsored retirement plans are converting from traditional pension plans to defined contribution plans, retirees' income structure has changed significantly over the past few decades. I compared lifetime income from pension plans/annuity contracts and social security retirement income from 2018 HRS with the 1990's numbers found in Reno's article, The Role Of Pensions In Retirement Income: Trends And Questions.⁵ The average total annuitized income portion (pension/annuity + social security) among all retirement income resources decreased by 6%.

My first thought was, "a 6% decrease isn’t too bad;" however, when I dug deeper into the numbers, I found that in 1990 the average portion of lifetime income from pension plans and/or annuities, among all annuitized income, was about 33%, and the rest was social security. In 2018, this number was only 18%. The numbers show that there is a clear trend that retirees are relying more on social security income as the only source of guaranteed lifetime income. This trend is expected to continue for Generation X retirees as access to traditional pension plans decreases.

[Figure 2] Based on data from the 2018 Health and Retirement Study, the sources of retirement income can dramatically impact retirement satisfaction.

[Figure 2] Based on data from the 2018 Health and Retirement Study, the sources of retirement income can dramatically impact retirement satisfaction.

The lower level of annuitized assets could also explain why people are becoming increasingly worried about running out of money and less satisfied with their retirement. When retirees were asked how they felt about their retirement income, 35% said they worried about running out of money in the future. However, almost 50% of retirees without any form of lifetime income were worried about running out of money in retirement. In comparison, only 25% of those who received regular paychecks from their pension plans or annuity contracts were extremely worried about running out of money in retirement. The regression results also confirmed that having guaranteed lifetime income has a positive impact on reducing anxiety about running out of money in retirement.⁶

Final Thoughts

Guaranteed and lifetime are the two most attractive and unique features of social security and pension income. For defined contribution (DC) participants, products that will be useful to them for funding their retirement income, are likely to feature each of these attributes. Looking ahead, we need to consider how plan sponsors can help their participants secure their retirement and fulfill their needs. And we can expect that only some DC participants can afford to work with a financial advisor to plan for distributing retirement assets. This creates a need and an opportunity for plan sponsors to deliver financial education, especially covering the distribution phase, and provide access to guaranteed lifetime income products to their participants.

Looking into research about behavioral bias, affective forecasting, and managing retirement expectations reminds me of a recent conversation I had with a gentleman at a conference. He said, “My dad owns a pension plan, and he knows little about it, but he has lived happily with his monthly paycheck for almost 20 years.” For me, the story about his father is a reminder that sometimes less is more: less unrealistic expectations about retirement can lead to more retirement satisfaction.

About Dr. Qi SunDr. Qi Sun is the Financial Economist for Pacific Life’s Institutional Division. Her research focuses on longevity insurance, household asset allocation decisions, and financial well-being. Qi holds a bachelor’s degree in Finance from Donghua University, a master’s degree in Personal Financial Planning from the University of Missouri, Columbia, and a doctorate in Personal Financial Planning from Texas Tech University. |

learn more

References:

1 Wilson, T. D., & Gilbert, D. T. (2003). Affective Forecasting.https://www.sciencedirect.com/science/article/abs/pii/S0065260103010062?via%3Dihub

2 Figure 1 represents average numbers between 1994 to 2018.

3 The number is estimated by this author based on data from the 2018 Health and Retirement Study.

4 Amos Tversky, Daniel Kahneman, “Loss Aversion in Riskless Choice: A Reference-Dependent Model,” The Quarterly Journal of Economics v106, Issue 4, 1991

5 Reno, V. P. (1993). The Role Of Pensions In Retirement Income: Trends and questions. Soc. Sec. Bull., 56, 29. https://www.ssa.gov/policy/docs/ssb/v56n1/v56n1p29.pdf

6 The number is estimated based on data from the 2018 Health and Retirement Study and regression results are available based on request.

Dr. Qi Sun is an employee of Pacific Life. The opinions expressed in Financial iQ with Dr. Qi are her own and not those of the Company.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products. Pacific Life, its affiliates, its distributors, and respective representatives do not provide any employer-sponsored qualified plan administrative services or impartial advice about investments and do not act in a fiduciary capacity for any plan.

This material is provided for informational purposes only and should not be construed as investment, tax, or legal advice.

Information is based on current laws, which are subject to change at any time. Clients should consult with their accounting or tax professionals for guidance regarding their specific financial situations.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company or Pacific Life & Annuity Company. In New York, insurance products are only issued by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

IDI0113

IDE0055

.jpg)