Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Qi Sun Ph.D., CFP | Financial iQ with Dr. Qi | June 20, 2022

Key Takeaways

- Expectations and other factors impact retirement happiness

- Perception is reality (and that’s not always a good thing)

- Happiness isn’t a constant, it fluctuates

- Research shows that we can positively influence our retirement happiness

Happiness in Retirement? Here’s What the Research Says

Retirement is a big life decision, and it's not a simple one-time event. Retirement acts like a transition process from a working role to the role of a retiree. Retirement satisfaction could be an indicator of how successful this transition was, and it reflects the level of psychological well-being of the retiree. To understand retirement satisfaction, we need to look at the big picture and identify what factors play an essential role in the transition process.

Which Factors Create Successful Retirement Outcomes?

In the financial industry, everyone talks about saving for retirement. This focus on saving leads to an illusion that people will feel happier when they achieve their retirement-saving goals and accumulate enough assets to secure their retirement life. I am not saying this is wrong; in fact, research focusing on economic well-being often assumes that a higher level of retirement income and/or wealth, increases overall well-being.¹ However, as Keith Bender mentions in his research, “Economic well-being is only one dimension of overall well-being.”² Even though accumulating enough savings secures the retirement-transition process financially, it does not guarantee the transition process will be smooth and successful.

The Five-Year Itch

On one hand, everyone is different, and their unique experience of the retirement-transition process leads to various levels of retirement satisfaction. For example, economic resources, such as net worth and retirement income, are more likely to contribute to men's retirement satisfaction than to women’s. Also, married couples show a higher level of retirement satisfaction compared to divorced couples, when faced with similar financial situations. On the other hand, these various segments can share the same patterns of retirement satisfaction during the retirement years.¹

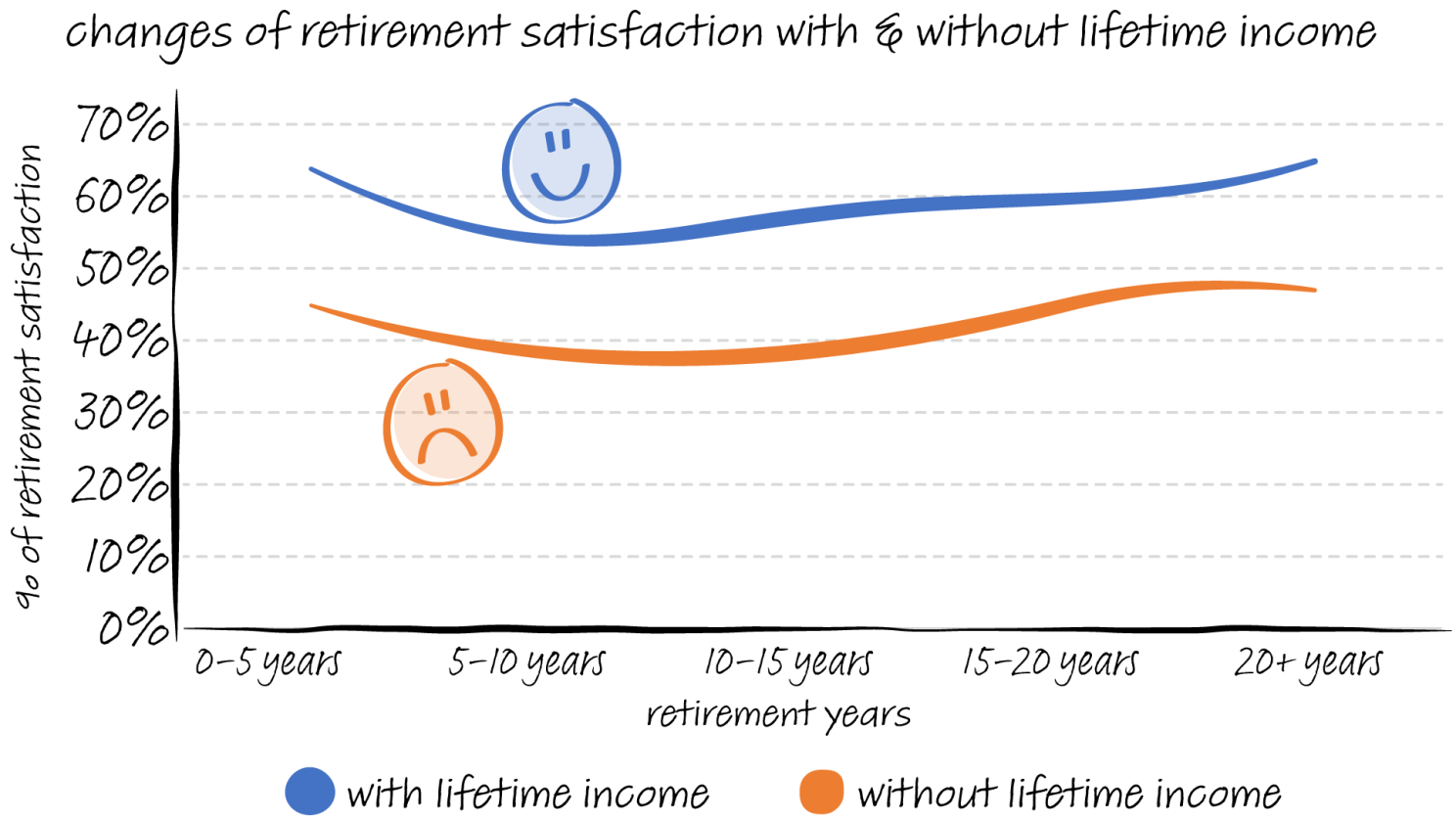

Graphic 1 shows how retirement satisfaction changes throughout retirement. Results are based on our internal analysis of data from the 2018 Health and Retirement Study.

Graphic 1 shows how retirement satisfaction changes throughout retirement. Results are based on our internal analysis of data from the 2018 Health and Retirement Study.

People are excited about a fresh start and a new chapter of life—being free from their career and focusing more on family and themselves. Correspondingly, they show a relatively high level of retirement satisfaction in the early retirement years. However, there is a significant drop in retirement satisfaction after the first five years. Their illusion of a perfect retirement life is broken, and retirees get used to their daily retirement schedule. Some of them may start missing old work routines, colleagues, and those elevator conversations.

The Ten-Year Bump

Interestingly, the level of satisfaction gradually returns to the previous level after ten years of retirement. Research papers refer to this phenomenon as a "hedonic adaptation."³ The theory posits that people react to good and bad events that happen to them, but the positive or negative effects will not last long, and people will ultimately revert to their previous levels of happiness. If this is the case, the set point of the initial level of retirement satisfaction is crucial. We need to have realistic expectations about our retirement life based on our individual circumstances. An unrealistic illusion of retirement life is not a good set point to start retirement, doing so can set the stage for disappointment.

Happiness = Perception + Facts

Nobel Prize winners Amos Tversky and Daniel Kahneman presented the "Reference-Dependent Preferences" theory, explaining that people evaluate their current circumstance relative to a reference point (often the past state).⁴ Hence, from a retirement-planning perspective, we want to help people manage their financial and mental "reference points" as they envision their retirement. Transferring part of a retirement portfolio into lifetime income products makes estimating lifetime-retirement income more straightforward and realistic. An accurate estimation of retirement income before retirement can help people start with an advantage set point.

Graphic 2 shows that those with zero lifetime income as part of their retirement budget began with a disadvantaged set point. Results are based on our internal analysis of data from the 2018 Health and Retirement Study.

Graphic 2 shows that those with zero lifetime income as part of their retirement budget began with a disadvantaged set point. Results are based on our internal analysis of data from the 2018 Health and Retirement Study.

No matter how retirement satisfaction fluctuates over the years, even considering the "hedonic adaptation" phenomenon, their retirement satisfaction ended with a lower level compared to groups receiving lifetime income in retirement. In addition, those receiving lifetime income show higher satisfaction in retirement than retirees who are more affluent but do not receive lifetime income.

Turning Retirement Research into Retirement Success

Many factors contribute to a successful retirement. Financially, you want to secure your retirement savings, but this is not enough. Choosing a purposeful "reference point" and skillfully adjusting retirement life based on the "reference point" may be responsible for more than 50 percent of the difference in retirement satisfaction among retirees.

About Dr. Qi SunDr. Qi Sun is the Financial Economist for Pacific Life’s Institutional Division. Her research focuses on longevity insurance, household asset allocation decisions, and financial well-being. Qi holds a bachelor’s degree in Finance from Donghua University, a master’s degree in Personal Financial Planning from the University of Missouri, Columbia, and a doctorate in Personal Financial Planning from Texas Tech University. |

Learn More

References

1 https://advisor.visualcapitalist.com/three-different-types-of-inflation/

2 CPI data comes from the U.S. Bureau of Labor Statistics: https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

3 Doepke, M., & Schneider, M. (2006). Inflation and the redistribution of nominal wealth. Journal of Political Economy, 114(6), 1069-1097.

4 Gorodnichenko, Y., Song, J., & Stolyarov, D. (2013). Macroeconomic determinants of retirement timing (No. w19638). National Bureau of Economic Research.

5 Pfau, W. D. (2011). Can We Predict the Sustainable Withdrawal Rate for New Retirees?

6 https://budgetmodel.wharton.upenn.edu/issues/2021/12/15/consumption-under-inflation-costs

Dr. Qi Sun is an employee of Pacific Life. The opinions expressed in Financial iQ with Dr. Qi are her own and not those of the Company.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products. Pacific Life, its affiliates, its distributors, and respective representatives do not provide any employer-sponsored qualified plan administrative services or impartial advice about investments and do not act in a fiduciary capacity for any plan.

This material is provided for informational purposes only and should not be construed as investment, tax, or legal advice.

Information is based on current laws, which are subject to change at any time. Clients should consult with their accounting or tax professionals for guidance regarding their specific financial situations.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company or Pacific Life & Annuity Company. In New York, insurance products are only issued by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

IDI0113

IDE0034

.jpg)