Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Qi Sun Ph.D., CFP | August 2025

THE DYNAMIC U.S. FAMILY: How Changing Family Structure Impacts Retirement Preparation

The structure of the American family has evolved significantly over the past few decades, as highlighted in the 2023 The Modern American Family report by the Pew Research Center.

In 1970, 67% of Americans aged 25 to 49 lived with their spouse and at least one child under 18. By 2021, that number had dropped to just 37%. As the traditional two-parent household with children plays a less dominant role, Americans have embraced a broader spectrum of family structures. One increasingly popular arrangement is married couples choosing not to have children. In fact, over 73% of U.S. adults now report feeling completely comfortable with this lifestyle.

Financial considerations play a significant role in this trend. According to the U.S. Department of Labor, the median cost of paid childcare in 2018 ranged from 8.0% to 19.3% of median household income. Post-pandemic inflation has further exacerbated this burden, with childcare costs increasing by approximately 22%. Unsurprisingly, the financial strain of raising children is frequently cited as a top reason for remaining child-free.

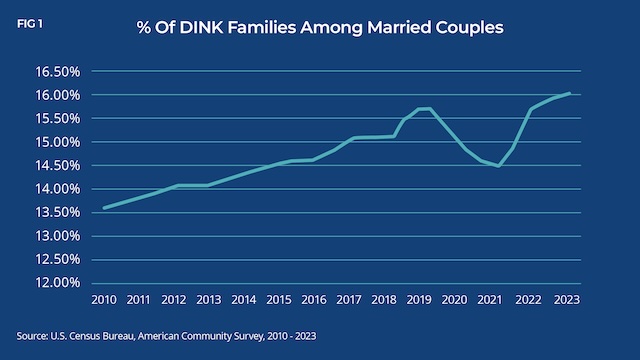

FIGURE 1: PERCENTAGE OF DINK FAMILIES AMONG MARRIED COUPLES

FIGURE 1: PERCENTAGE OF DINK FAMILIES AMONG MARRIED COUPLES

Source: U.S. Census Bureau, American Community Survey, 2010 - 20231

Dual Income, No Kids (DINK) households and families are often perceived as being more financially secure than their Dual Income, With Kids (DWIK) counterparts, due to the absence of child-rearing expenses. In this research, we aim to examine the retirement savings journeys of these two distinct dual-income family structures, discovering how their financial priorities and outcomes differ.

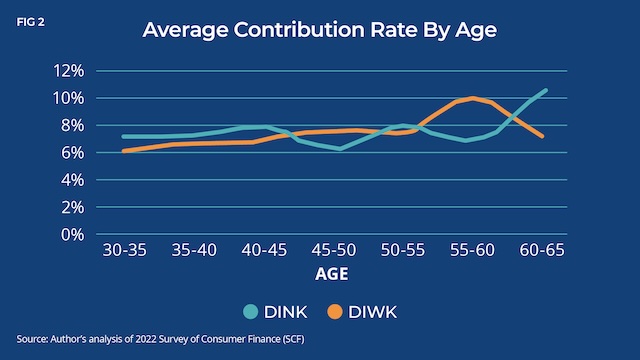

Using the data from the 2022 Survey of Consumer Finance, we first compared how DINK and DIWK families save through their employer-sponsored retirement plans at different life stages. As Figure 2 shows, despite having more disposable income, DINK families do not fully commit to retirement savings in their earlier years. Their average contribution rate before employer-matching is consistently below DIWK families until mid-career age. Research suggests that DINK households are typically enthusiastic spenders, especially allocating a majority of their resources to travel and pets, versus retirement savings.

FIGURE 2: AVERAGE CONTRIBUTION RATE BY AGE

FIGURE 2: AVERAGE CONTRIBUTION RATE BY AGE

Source: Author’s analysis of 2022 Survey of Consumer Finance (SCF)

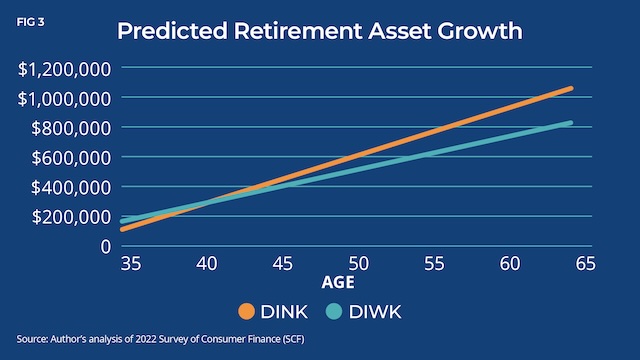

Next, we analyzed the retirement assets accumulated in employer-sponsored retirement plans and Individual Retirement Accounts (IRAs) for both DINK and DIWK families prior to age 65, a commonly assumed retirement age. When controlling for factors such as education level, income, and ethnicity for both respondents and their spouses/partners, a clear trend emerges: while DIWK families tend to have higher retirement assets earlier in their careers, DINK families surpass them after mid-career. This asset gap continues to grow, reaching approximately $200,000 in favor of DINK families when close to retirement age (Figure 3).

FIGURE 3: PREDICTED RETIREMENT ASSET GROWTH

FIGURE 3: PREDICTED RETIREMENT ASSET GROWTH

Source: Author’s analysis of 2022 Survey of Consumer Finance (SCF)2

This finding highlights the lifestyle differences between the two groups. DINK families often prioritize present enjoyment over long-term planning in their younger years. However, as retirement nears and the need to secure their financial future becomes more urgent, they exhibit a remarkable ability to significantly accelerate their savings efforts. Free from the financial obligations of raising children, DINK families can redirect their resources toward building a substantial nest egg in the later stages of their careers.

CONCLUSION

The rise of DINK households represents a profound shift in American family dynamics, bringing both challenges and opportunities for public policy and the retirement industry. This change highlights evolving priorities and growing economic pressures, such as soaring childcare costs and concerns about the long-term sustainability of Social Security.

At the same time, the distinct financial habits of DINK households underscore the need for customized strategies to help them avoid potential retirement challenges, particularly since they cannot rely on financial support from children. Tailored financial education and tools are essential to guide these families toward a more secure future. By focusing on the importance of early and consistent retirement contributions, the retirement industry can help DINK households balance their present-focused lifestyle with their long-term financial goals, ensuring they are well-prepared for the years ahead.

About Qi Sun Ph.D., CFPDr. Qi Sun is the Financial Economist for Pacific Life’s Institutional Division. Her research focuses on longevity insurance, household asset allocation decisions, and financial well-being. Qi holds a bachelor’s degree in Finance from Donghua University, a master’s degree in Personal Financial Planning from the University of Missouri, Columbia, and a doctorate in Personal Financial Planning from Texas Tech University. |

Learn More

1 A DINK family is defined as a dual full-time employed married couple without children. Due to the COVID-19 pandemic, the 2020 DINK family data relies on 5-year ACS estimates instead of 1-year estimates from the U.S. Census Bureau.

2 We run a regression to predict retirement assets (including both workplace retirement accounts and Individual Retirement Accounts (IRAs)), by controlling education level, income, and ethnicity for both respondents and their spouses/partners.

TO LEARN MORE, PLEASE CALL YOUR DEDICATED PACIFIC LIFE REPRESENTATIVE OR CALL (877) 536-4382 (OPTION 1) OR EMAIL RETIREMENTINCOME@PACIFICLIFE.COM.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products. Pacific Life, its affiliates, its distributors, and respective representatives do not provide any employer-sponsored qualified plan administrative services or impartial advice about investments and do not act in a fiduciary capacity for any plan.

This material is provided for informational purposes only and should not be construed as investment, tax, or legal advice.

Information is based on current laws, which are subject to change at any time. Clients should consult with their accounting or tax professionals for guidance regarding their specific financial situations.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company or Pacific Life & Annuity Company. In New York, insurance products are only issued by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

IDI0113

DCLI0172

.jpg)