Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Qi Sun Ph.D., CFP | Financial iQ with Dr. Qi | August 2024

Key Takeaways

- Chronic Diseases and Multi-morbidity Increase with Age: Approximately 10% of the U.S. population has more than four co-existing chronic conditions. This number climbs to over 30% for individuals over the age of 65, and it is projected to increase by at least 60% by 2050.

- Increased Medical Expenses: Individuals with chronic conditions are up to 50% more likely to incur out-of-pocket medical expenses, and these expenses can severely impact their financial stability, especially if they are dependent on fixed incomes like Social Security.

- Gender and Racial Disparities in Medical Spending: Women generally have higher out-of-pocket medical expenses as the number of chronic conditions increases. Additionally, influenced by various socioeconomic factors, African Americans and other groups spend less on medical expenses compared to White Americans.

- Reduced Non-Medical Spending Due to Chronic Diseases: Older Americans with chronic diseases tend to spend less on both discretionary and non-discretionary non-medical items, possibly influenced by the fear of depleting resources due to unpredictable medical costs.

- Strategies for Managing Financial Risks: Adjusting lifestyle habits and establishing Health Savings Accounts can help manage the financial impact of chronic diseases, ensuring better retirement outcomes.

Hidden Hurdle to The Golden Age: The Financial Impact of Chronic Disease on Older Americans

Older Americans face numerous health-related challenges, including chronic diseases, that can significantly impact their quality of life. These chronic conditions can escalate quickly into multimorbidity, a scenario where multiple diseases or conditions are present simultaneously. In addition to chronic diseases, older adults may also experience functional impairments due to hearing and vision problems, as well as mental health issues.

Chronic conditions are increasingly recognized as a significant national health issue. Many people are unaware that having one chronic condition increases the risk of developing others. For example, asthma often co-occurs with diabetes1, and depression is frequently linked to stroke2. According to a study based on the 2016-2019 Medical Expenditure Panel Survey, about 10% of the U.S. population has more than four co-existing chronic conditions. This percentage rises to over 30%3 for individuals over the age of 65. By 2050, it is projected that the number of older Americans with multiple chronic conditions will increase by at least 60%.4

Multiple chronic conditions significantly increase healthcare utilization and complicate treatment, leading to a sharp rise in associated medical costs. These rising costs create a major area of uncertainty during retirement, with many retirees fearing the depletion of their savings. In this issue of Financial IQ, I will explore how chronic diseases influence out-of-pocket medical expenses and daily spending habits for older Americans, especially those with multiple conditions.

Calculating the Financial Burden of Chronic Diseases

Considering factors related to an individual's out-of-pocket medical expenditures, such as their social-demographic background (age, gender, ethnicity, etc.), financial capability (income and wealth level), insurance coverage (public and private coverage), and physical health conditions (physical functional limitations), we used a two-part model5 to predict:

1. The factors that could increase the chance of incurring out-of-pocket medical expenditures in addition to health insurance premiums

2. Whether having co-existing chronic conditions will further increase the financial burden if people spend a certain amount out-of-pocket on non-premium medical expenses.

Based on the model prediction, having multiple chronic conditions does increase the probability of out-of-pocket medical expenditures6 and exacerbates the severity of economic hardship for individuals with severe physical and/or cognitive health problems.

On average, individuals with one chronic condition are approximately 30% more likely to incur out-of-pocket medical expenses compared to those with no chronic diseases. This probability increases to about 50% for individuals with four or more co-existing conditions, which, as previously noted, is not uncommon among older people.

Due to the decline in physical and cognitive capabilities, older individuals often require additional assistance; ranging from minimal help, such as medication reminders; to full dependencies, such as long-term care facilities, for their daily activities. The financial impact of acquiring an additional chronic condition also varies depending on the level of independence in performing daily activities.

As shown in Figure 1, after acquiring a new chronic condition, the projected out-of-pocket medical expenses rise significantly for those who reported difficulty in performing three or more activities of daily living.7 The out-of-pocket cost can reach approximately $16,0008 per-year for individuals who have completely lost independence in their daily activities.

[FIGURE 1] Note: The figure is estimated by the author, using the core data from the 2020 Health and Retirement Study.

[FIGURE 1] Note: The figure is estimated by the author, using the core data from the 2020 Health and Retirement Study.

It is important to note that, according to the 2022 Social Security Administration Annual Report, the average annual Social Security benefit for individuals aged 66 to 69 is $22,250.9 Therefore, for those who rely solely on Social Security retirement income, handling the medical expenses associated with newly acquired chronic conditions can pose a significant financial burden, especially if they are already struggling with their daily living needs.

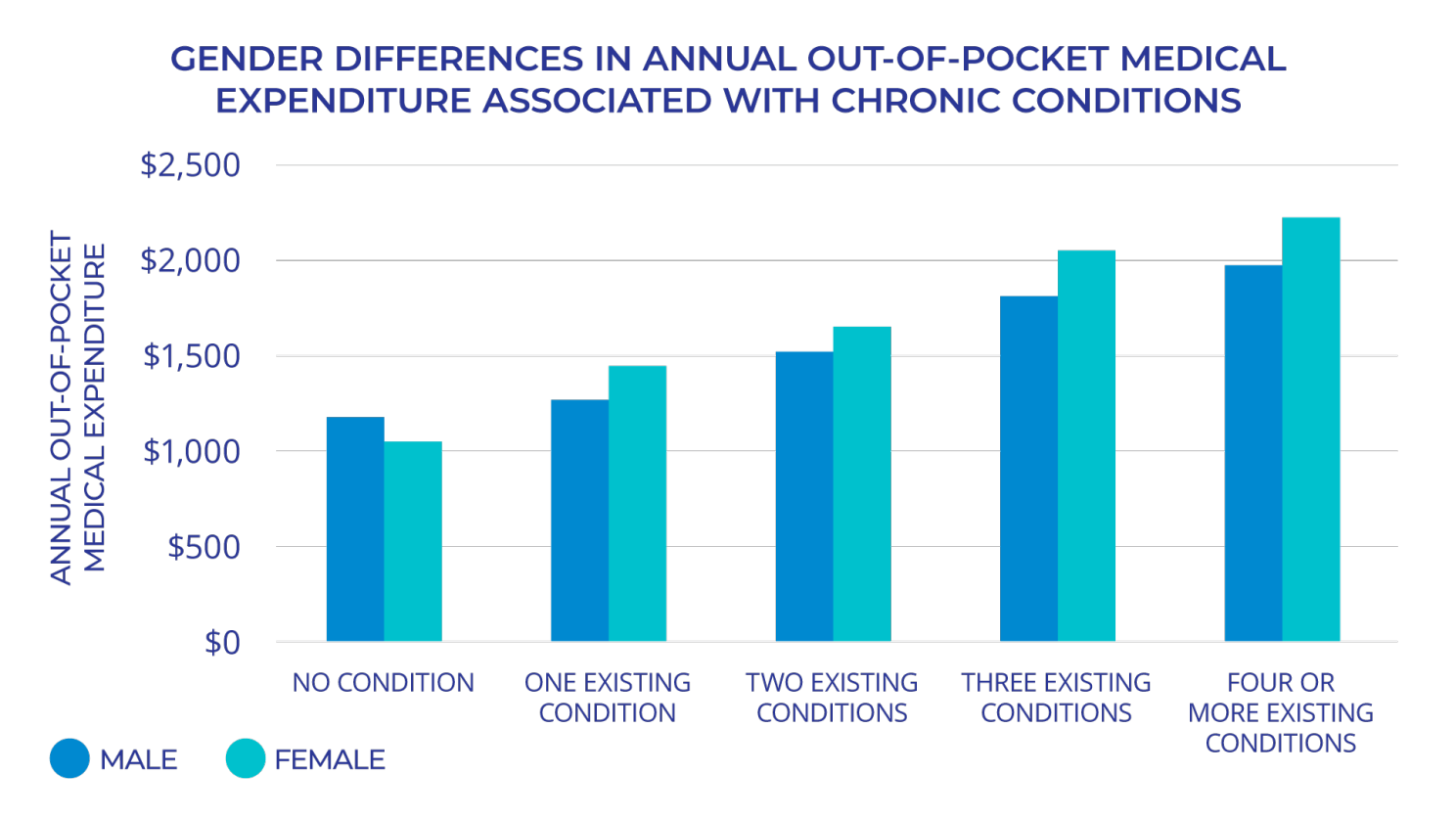

How Gender & Other Demographics Impact Spending

The model also provides clear evidence that, on average, women are more likely than men to have out-of-pocket medical expenses. Researchers attribute this additional medical cost to emotional comfort, when women are sick, they tend to visit doctors more frequently for peace of mind rather than for actual treatment. The data also highlights the disparities in out-of-pocket medical expenses between women and men, particularly in cases of multiple co-existing chronic conditions. Figure 2 shows—after accounting for all relevant factors—women spend less than men when there are no existing chronic conditions. However, as the number of coexisting chronic conditions increases, women's out-of-pocket expenses rise and exceed those of men.

[FIGURE 2] Note: The figure is estimated by author, using the core data from the 2020 Health and Retirement Study.

[FIGURE 2] Note: The figure is estimated by author, using the core data from the 2020 Health and Retirement Study.

In comparison to White Americans, we found that other groups had a lower probability of incurring—and less out-of-pocket—medical expenses, regardless of whether they were impacted by chronic conditions. African Americans and other racial groups spent $720 and $417 less, respectively, on medical expenses than White Americans, even though they had no chronic conditions. The disparity in medical spending widens with an increasing number of co-existing chronic conditions.

Previous research explains this unequal utilization of medical resources as being influenced by stress resulting from discrimination, differential experiences in the labor market; and exposure to early-life, household, and neighborhood poverty.10 For example, African Americans have been found to be less likely than White Americans to allocate economic gains towards healthcare resources.

Chronic Disease Impacts Spending Habits

After examining the out-of-pocket medical expenses, we studied the impact of chronic diseases on the spending habits of older Americans, particularly those with multiple co-existing conditions. To do this, we utilized data from the 2005-2021 Consumption and Activities Mail Survey (CAMS) conducted as part of the Health and Retirement Study. This allowed us to analyze non-medical spending patterns of two groups: the “healthy” group, consisting of individuals who reported no chronic diseases throughout the survey period, and the “unhealthy” group, comprised of those who reported at least one chronic disease.

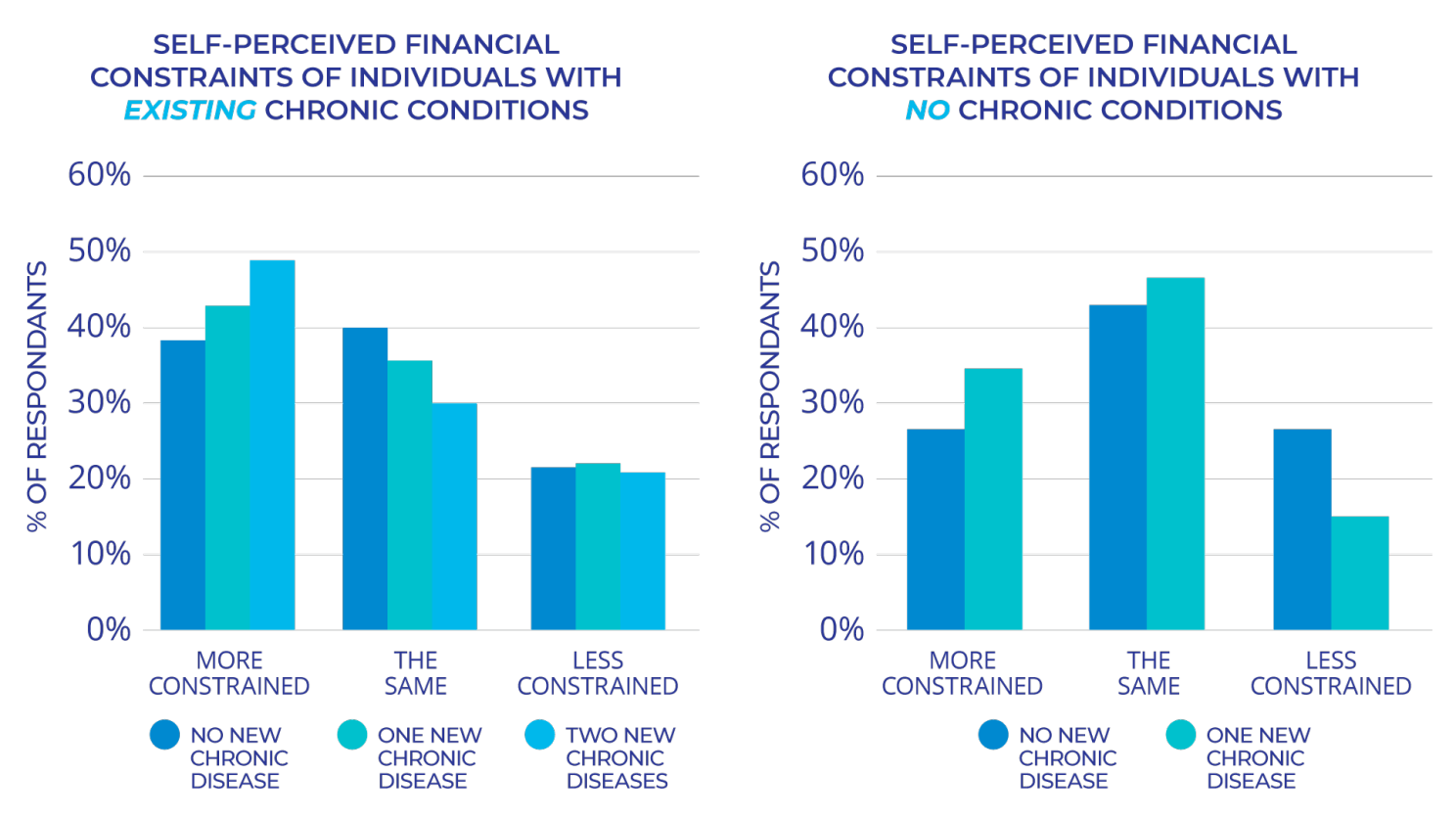

Initially, we explored participants' thoughts and feelings regarding their financial situation compared to the previous survey period. Figure 3 illustrates that a higher percentage of individuals in the unhealthy group expressed feeling more financially constrained than they did during the prior survey period. Notably, even individuals with previously good health who acquired new chronic conditions tended to experience a greater sense of constraint, as shown in Figure 4.

[FIGURE 3 (LEFT) FIGURE 4 (RIGHT)]

Note: Figures 3 & 4 are estimated based on the data from 2021 Consumption and Activities Mail Survey (CAMS). Because of the small sample size, for the “No Chronic Conditions” group, we only documented up to one new chronic disease.

[FIGURE 3 (LEFT) FIGURE 4 (RIGHT)]

Note: Figures 3 & 4 are estimated based on the data from 2021 Consumption and Activities Mail Survey (CAMS). Because of the small sample size, for the “No Chronic Conditions” group, we only documented up to one new chronic disease.

Feeling Healthy Enough to Spend

Lastly, the CAMS tracked the discretionary and non-discretionary non-medical spending of the same respondents separately over a decade. Therefore, we can compare spending patterns for both the “healthy” and “unhealthy” groups in different economic environments. Since individual spending patterns are often influenced by their wealth level, we further divided the net worth into quantiles to represent the effect of wealth.

Overall, our findings show that individuals with chronic diseases spent less, compared to their healthy peers, in both discretionary and non-discretionary non-medical spending within each quantile of net worth (Figure 5, Figure 6). This suggests that having multiple co-existing chronic conditions limits the spending power of older individuals, regardless of their wealth status. The reduction in spending may not be solely attributed to increased medical bills11, but also to the fear of running out of money in the future due to the uncertainty.

![[FIGURE 5 (LEFT) FIGURE 6 (RIGHT)]](/content/pl-corp/institutional-insights/financial-impact-of-chronic-disease/_jcr_content/root/responsivegrid/wpar/simplecolumns_677622846/par1/image_1281324397_cop.img.png/1759794452961.png) FIGURE 5 (LEFT) FIGURE 6 (RIGHT) Note: Figure 5&6 are estimated based on the data from 2005 -2019 Consumption and Activities Mail Survey (CAMS).

FIGURE 5 (LEFT) FIGURE 6 (RIGHT) Note: Figure 5&6 are estimated based on the data from 2005 -2019 Consumption and Activities Mail Survey (CAMS).

Additionally, we observed that the spending behavior of individuals with chronic diseases is more "inelastic," meaning their spending does not vary significantly with changes in the economic environment. In contrast, the spending behavior of the healthy group fluctuated over time and was strongly influenced by the external financial market.

Conclusion

Chronic diseases are common among older Americans and can have a negative impact on their quality of life and financial well-being. Chronic diseases, particularly multimorbidity, can lead to increased out-of-pocket medical expenses and reduced spending on non-medical expenses. However, reduced consumption may not solely be caused by medical bills. The fear of uncertain medical costs may cause older adults to spend less in order to deal with this uncertainty. For instance, individuals with chronic diseases may be more inclined to use coupons and discounts when grocery shopping to save money for their treatments. Therefore, more empirical findings are needed to shed light on the complex interplay of health challenges faced by older Americans. Additional research can also help address the multifaceted needs of individuals with multiple chronic conditions, which could significantly improve the overall quality of life for the aging population.

The good news is that chronic diseases can be managed and prevented by adjusting one's diet and engaging in physical activity. Additionally, setting up a separate savings account, either via an employer-sponsored Health Savings Account (HSA), or an emergency savings account, can greatly alleviate individuals' concerns about uncertain medical expenses and ensure the sufficiency of retirement income. According to a study by EBRI, HSAs play a crucial role in improving retirement readiness, and increasing access to HSAs and promoting investment among HSA accountholders could significantly reduce the overall retirement savings shortfall.12 Future studies could provide valuable information if they can show the impact that HSAs have on retirees’ "appetite" to spend.

About Dr. Qi SunDr. Qi Sun is the Financial Economist for Pacific Life’s Institutional Division. Her research focuses on longevity insurance, household asset allocation decisions, and financial well-being. Qi holds a bachelor’s degree in Finance from Donghua University, a master’s degree in Personal Financial Planning from the University of Missouri, Columbia, and a doctorate in Personal Financial Planning from Texas Tech University. |

Learn More

1 Smith SM, O'Dowd T. Chronic diseases: what happens when they come in multiples? Br J Gen Pract. 2007 Apr;57(537):268-70. PMID: 17394728; PMCID: PMC2043326.

2 Hajat C, Stein E. The global burden of multiple chronic conditions: A narrative review. Prev Med Rep. 2018 Oct 19;12:284-293. doi: 10.1016/j.pmedr.2018.10.008. PMID: 30406006; PMCID: PMC6214883.

3 Schiltz, N. K. (2022). Prevalence of multimorbidity combinations and their association with medical costs and poor health: A population-based study of US adults. Frontiers in Public Health, 10, 953886.

4 Ansah JP, Chiu CT. Projecting the chronic disease burden among the adult population in the United States using a multi-state population model. Front Public Health. 2023 Jan 13;10:1082183. doi: 10.3389/fpubh.2022.1082183. PMID: 36711415; PMCID: PMC9881650.

5 https://www.annualreviews.org/doi/pdf/10.1146/annurev-publhealth-040617-013517

6 Out-of-pocket medical expenditures include hospital and nursing home, surgery, doctor visits, dental visits, home health services, special facilities and services, and other medical expenses. Prescribed drugs and health insurance premiums are excluded for the consideration of Part D of Medicare.

7 The prediction result has controlled for social demographics, financial factors and health conditions.

8 In 2020 dollars

9 https://www.ssa.gov/policy/docs/statcomps/supplement/2022/5b.html

10 Boen, C., Keister, L., & Aronson, B. (2020). Beyond net worth: Racial differences in wealth portfolios and black–white health inequality across the life course. Journal of health and social behavior, 61(2), 153-169.

11 Previous research also found that increased medical expenditures did not drive the decline in non-medical expenditures after a health shock (Ooijen et al., 2018). Another explanation for the decreased consumption among unhealthy people, instead, is the changes in the marginal utility of consumption. This implies that sick individuals do not derive the same level of enjoyment as healthy individuals when consuming the same food or service (Blundell et al., 2020).

Dr. Qi Sun is an employee of Pacific Life. The opinions expressed in Financial iQ with Dr. Qi are her own and not those of the Company.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products. Pacific Life, its affiliates, its distributors, and respective representatives do not provide any employer-sponsored qualified plan administrative services or impartial advice about investments and do not act in a fiduciary capacity for any plan.

This material is provided for informational purposes only and should not be construed as investment, tax, or legal advice.

Information is based on current laws, which are subject to change at any time. Clients should consult with their accounting or tax professionals for guidance regarding their specific financial situations.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company or Pacific Life & Annuity Company. In New York, insurance products are only issued by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

IDI0113

DCLI0132

.jpg)