Focus on: The Retirement Savings Gap

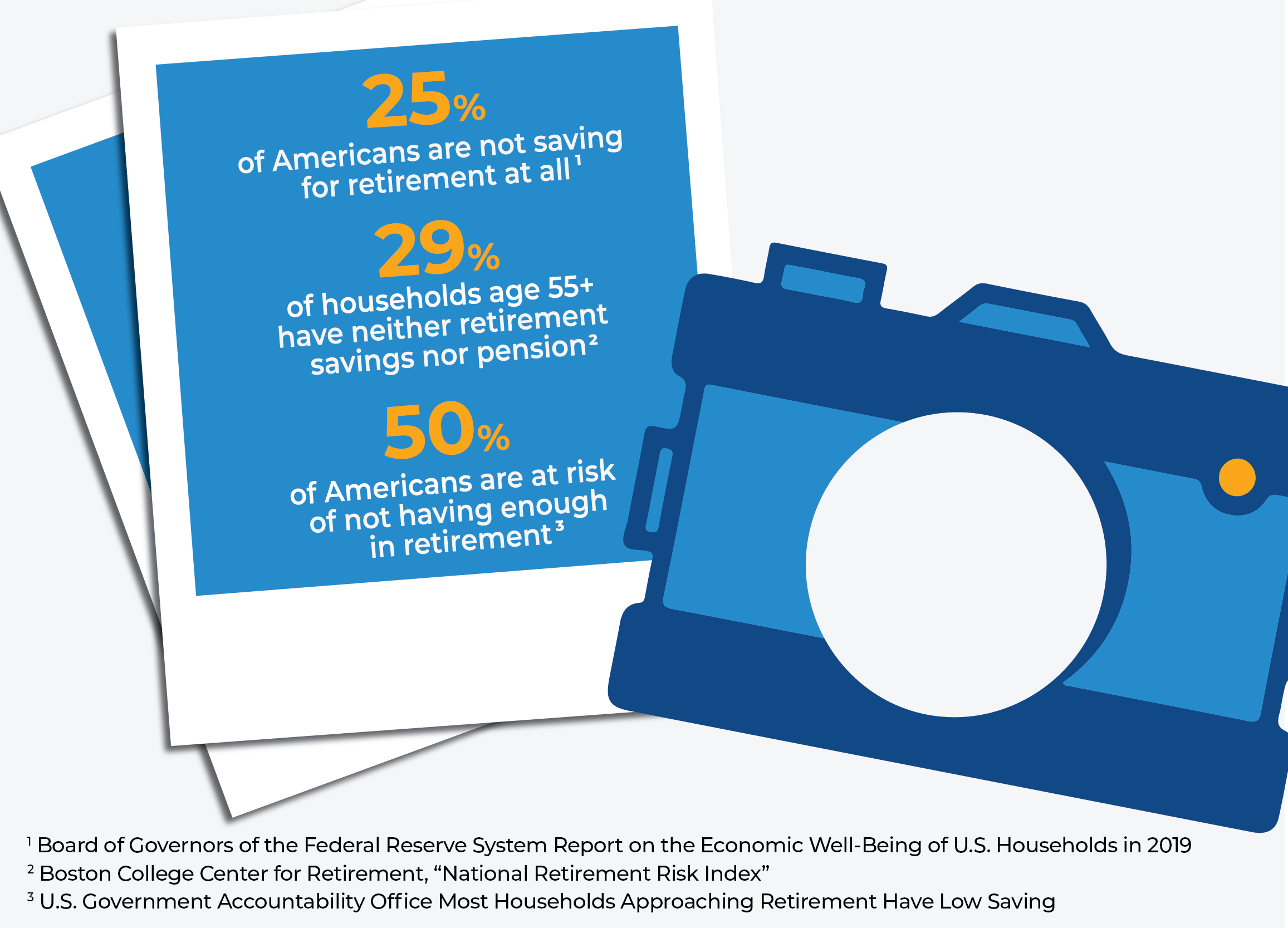

View a snapshot of how Americans save for the future.

How do your retirement savings compare?

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

You’re saving for a broad spectrum of goals. Whether you need money now—to pay bills, support your family, or maybe take a vacation—you also have an eye toward the future, looking to plan a comfortable retirement. In your 30s, retirement can seem far off, but by your 40s, the future comes into sharper focus. In your 50s, things become even clearer, and then suddenly you’re nearing retirement. No matter your stage in life, now’s the time to take proactive steps toward securing the financial future you want. Partner with a financial professional who can help you identify and meet savings goals, now and in the future.

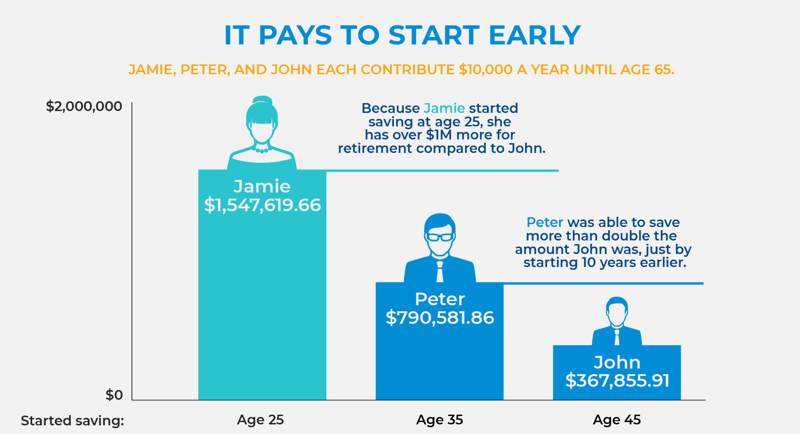

Some experts say you’ll need 80% of pre-retirement income after you retire. To get there, one rule of thumb is to aim to save 15% of your pre-tax income each year, including employer contributions. But the easiest way to ensure you’ll have enough for retirement is to start sooner rather than later. There are ways to play catch up (see below) but prioritizing your future today can help set you up for greater success down the road. That’s because the power of compounding gives your money more time to build.

* Calculations based on hypothetical examples - individual results may vary

Source: U.S. Securities and Exchange Commission Compound Interest Calculator

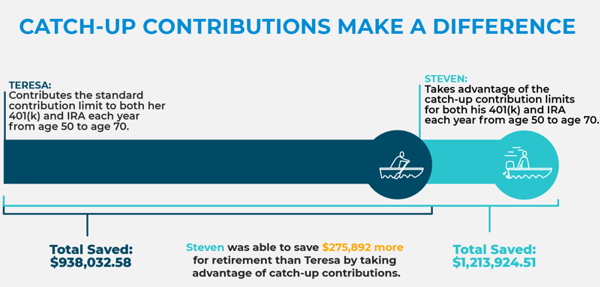

If you feel you’re behind or got a late start, there are steps you can take. For instance, from age 50 on, the government allows catch-up contributions to a 401(k), 403(b) or other retirement savings plans. In fact, for 2020, the IRS increased the catch-up rate to $6,500 annually— beyond the standard contribution limit of $19,500. Investors over age 50 can also take advantage of catch-up limits for the Traditional or Roth IRA account, which is $7,000, compared to the $6,000 standard contribution limit (IRS notice 2019-59). You can take even greater advantage of catch-up contributions by delaying your retirement by a few years, from age 65 to 70, for example. You also can consider an annuity, which allows you to lock in guaranteed income for life.

* Calculations based on hypothetical examples - individual results may vary; assumes annual return of 6% and IRS contribution limits for 2020

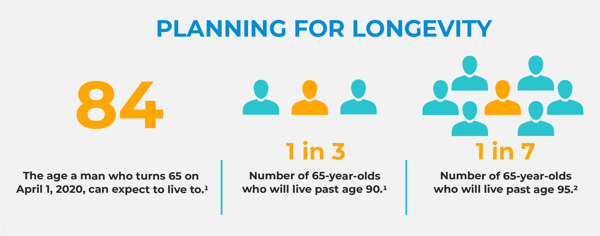

Life expectancy in the U.S. has risen over the past few decades, which means the number of years people living in retirement has risen, too. Today’s investors need to plan for a retirement that could last 20 to 30 years or more. While it’s impossible to forecast all your future needs, you can foretell the need for consistent income. That’s why annuities, with protected income that you can use as part of a comprehensive retirement plan, make an attractive option. They provide a steady, reliable income that can work with other retirement accounts to help give you the security you need.

1 Social Security Administration Life Expectancy Calculator

2 Social Security Administration Publications, “When to Start Receiving Retirement Benefits”

View a snapshot of how Americans save for the future.

How do your retirement savings compare?

A variable annuity is designed to provide reliable monthly income that lasts for life. It is a long-term investment that can help you grow your retirement savings faster by investing in a diverse selection of investment options while deferring taxes until you take income. The market-based investment performance will be variable, meaning it can go up or down. Variable annuities also allow you to provide for loved ones through a guaranteed death benefit.

A fixed indexed annuity is designed to provide reliable monthly income that lasts for life. It protects your principal, while providing growth opportunity based on the positive movement of an index, such as the S&P 500® index. Fixed indexed annuities enable you to grow your retirement savings faster by deferring taxes until you take income, creating lifetime income, and providing for loved ones through a guaranteed death benefit.

Offers death benefit protection with tax deferred cash value build up, and ability to access the cash value via policy loans and withdrawals.

For you, family is one of the most important things in your life. You take care of them. They take care of you. Making sure that they’ll always be taken care of, no matter what happens.

LEARN MORE

Being happily retired looks different for everybody. Maybe you want steady retirement income that lasts or supplemental income to help you meet the unexpected in life.

LEARN MORE

You want your business to maintain its competitive edge. Attracting talent and building a succession plan for the future means you can ensure your business stays in stable hands.

LEARN MOREFor you, family is one of the most important things in your life. You take care of them. They take care of you. Making sure that they’ll always be taken care of, no matter what happens.

LEARN MOREBeing happily retired looks different for everybody. Maybe you want steady retirement income that lasts or supplemental income to help you meet the unexpected in life.

LEARN MOREYou want your business to maintain its competitive edge. Attracting talent and building a succession plan for the future means you can ensure your business stays in stable hands.

LEARN MORELife insurance is subject to underwriting and approval of the application and will incur monthly policy charges.

In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not protect the value of the variable investment options, which are subject to market risk.

Pacific Life, its distributors, and respective representatives do not provide tax, accounting, or legal advice. Any taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor or attorney.

Annuity withdrawals and other distributions of taxable amounts, including death benefit payouts, will be subject to ordinary income tax. For nonqualified contracts, an additional 3.8% federal tax may apply on net investment income. If withdrawals and other distributions are taken prior to age 59½, an additional 10% federal tax may apply. A withdrawal charge and a market value adjustment (MVA) also may apply. Withdrawals will reduce the contract value and the value of the death benefits, and also may reduce the value of any optional benefits.

Under current law, a nonqualified annuity that is owned by an individual is generally entitled to tax deferral. IRAs and qualified plans—such as 401(k)s and 403(b)s—are already tax‑deferred. Therefore, a deferred annuity should be used only to fund an IRA or qualified plan to benefit from the annuity’s features other than tax deferral. These include lifetime income and death benefit options.

All investing involves risk, including the possible loss of the principal amount invested. The value of the variable investment options will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please see the prospectus for a detailed description of investment risks.

For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2)(i.e. the transfer-for-value rule); arrangements that lack an insurable interest based on state law; and an employer-owned policy unless the policy qualifies for an exception under IRC Sec. 101(j).

For federal income tax purposes, tax-free income assumes, among other things: (1) withdrawals do not exceed tax basis (generally, premiums paid less prior withdrawals); (2) policy remains in force until death (any outstanding policy debt at time of lapse or surrender that exceeds the tax basis will be subject to tax); (3) withdrawals taken during the first 15 policy years do not cause, occur at the time of, or during the two years prior to, any reduction in benefits; and (4) the policy does not become a modified endowment contract. See IRC §§ 72, 7702(f)(7)(B), 7702A. Any policy withdrawals, loans and loan interest will reduce policy values and may reduce benefits.

The "S&P 500® index" is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by Pacific Life Insurance Company. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Pacific Life’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500® index. The index is not available for direct investment, and index performance does not include the reinvestment of dividends.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life's Home Office is located in Newport Beach, CA.

PL1.1B