Conclusion and Findings

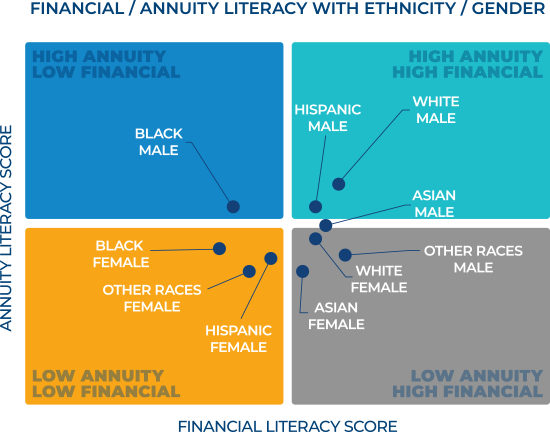

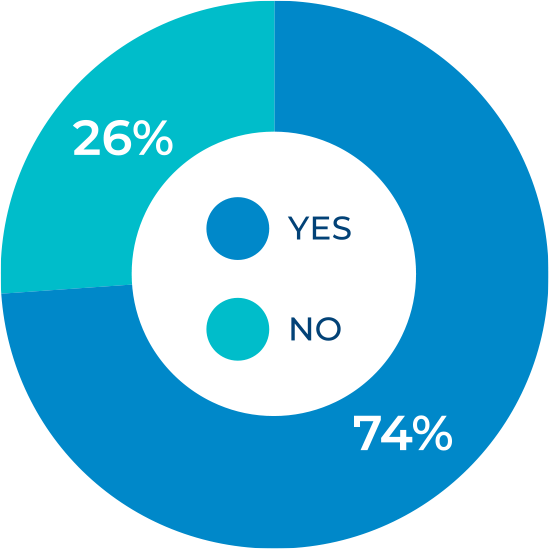

With defined contribution plans being the dominant employer-sponsored retirement plan, they should provide participants with the ability to turn some of their plan balance into guaranteed lifetime income to protect against the risk of outliving their retirement assets. At the same time, there is a need to address the challenge of helping participants realize how lifetime income can help them achieve their retirement expectations. This study provides insight into participants’ financial and annuity knowledge levels as well as their preferences for purchase frequency and amount, when to start income payments, and employer incentives.

The findings from this study can be leveraged when making decisions about providing financial education resources, personalizing communications to participants, and selecting lifetime income products for defined contribution plans.