This website or its third-party tools use cookies, which are necessary to its functioning and are required to achieve the purposes illustrated in our online privacy policy.

Thinking beyond basic retirement planning can give you greater financial flexibility in your golden years.

Your retirement strategy should begin with a tax-advantaged retirement account, but it doesn't have to end there. Supplementing your 401(k) or IRA with cash value life insurance can help give you greater financial flexibility during your lifetime while providing protection to your loved ones.

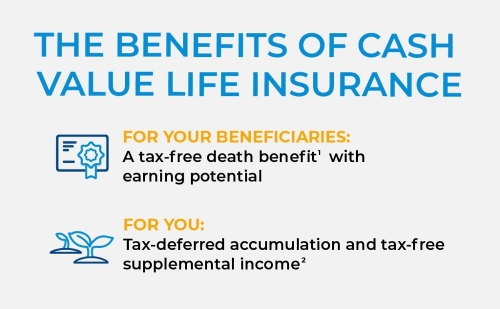

Unlike term life insurance, which only pays out a death benefit, cash value life insurance allows you to allocate your premiums inside the policy and gives you access to its available cash value while you’re alive. Cash value life insurance can also offer tax advantages that can benefit both you and your family.

Here are four ways cash value life insurance can enhance your retirement strategy:

1. Protection for loved ones

A cash value life insurance policy pays a tax-free death benefit1 to your beneficiaries at your death. Your family can use the policy death benefit in any way they wish. For instance, it may help with expenses such as day-to-day living costs or paying down a mortgage.

2. Tax-deferred growth potential

Cash value policies offer tax-deferred growth potential—giving you another vehicle you can use to invest toward the future. When you purchase a cash value life insurance policy, part of your premium is allocated into an investment option that can accumulate tax-deferred interest over time. This option may be especially appealing if you contribute the maximum annual amount to your retirement accounts and are looking for further tax-deferred growth opportunities.

3. Tax-free supplemental income potential2

Cash value life insurance offers the ability to access the available cash value through potentially tax-free2 loans or withdrawals. Such loans or withdrawals may help you and your family cover unexpected expenses before or during your retirement.

4. Risk management

A cash value life insurance policy may help diversify your financial portfolio, potentially reducing your portfolio’s overall volatility and risk of loss depending on the type of cash value life insurance you choose. What's more, some policies allow you to allocate money to indexed accounts that credit interest based in part on the performance of major stock market indexes.3 The interest rate credited for these accounts is protected from falling below a set level, which means your policy’s cash value is protected from market-based losses. Your cash value will be reduced only by policy charges and any loans, withdrawals, or other distributions you take from the policy.

If you're looking for a tool that protects your family in the event of the unexpected while also serving as a source of potentially tax-free2 supplemental retirement income, consider looking into a cash value life insurance policy. Work with a professional life insurance producer to help you find the product that best fits your situation and goals.

READ MORE

Retirement Planning

Talking Social Security With Mary Beth Franklin

Staying aware of current regulations set by the Social Security Administration can help retirees receive the full benefits they deserve.

Retirement Planning / Family

How Annuities Can Boost Your Retirement Savings

The tax-deferred growth potential of an annuity can boost your savings for the future.

Retirement Planning / Family

How to Enhance Your Retirement Strategy with Cash Value Life Insurance

Your retirement strategy should begin with a tax-advantaged retirement account, but it doesn't have to end there. Supplementing your 401(k) or IRA with cash value life insurance can help give you greater financial flexibility during your lifetime while providing protection to your loved ones.

Family / Estate Planning

What Blended Families Should Know About Estate Planning

An estate plan with an Irrevocable Life Insurance Trust may help reduce estate taxes and ensure equitable distribution of a blended family’s assets.

Family / Estate Planning

Ensuring a Smooth Transition for Your Family Business

A plan that includes life insurance can help provide liquidity and equality in a family business succession.

Home / Estate Planning

How to Help Protect Your Estate Plan from an Uncertain Future

A life insurance trust can help provide flexibility and protection for the future.

Family / Estate Planning

Estate Planning for Unmarried Couples

Life insurance can help maximize wealth transfer for unmarried couples.

Family / Estate Planning

5 Ways Life Insurance Can Help With Estate Planning

As you develop or update an estate plan, considering the following ways life insurance can help address your needs.

Career And Business

Retirement Savings Options at a New Job

Weigh your choices before deciding where—or whether—to move your retirement savings when you switch employers.

Retirement Planning

Ways to Retire Confidently

If you’re concerned about saving enough for retirement, a protected source of income can help put your mind at ease.

Retirement Planning / Home

Don’t Put Off Saving for Retirement

Start building your nest egg early to prepare for the unexpected.

Retirement Planning / Family

Managing Your Beneficiaries’ Inheritance

An annuity with a predetermined beneficiary payout option can offer greater control without a trust.

Retirement Planning

How to Save on Charitable Giving During Retirement

Qualified charitable distributions can help with tax savings and at the same time give to charity during retirement.

Retirement Planning

Picking the Right Type of IRA for You

Understanding the difference between a traditional and Roth IRA can go a long way in planning your retirement savings strategy.

Estate Planning / Family

How to Cope Without the Family Breadwinner

Take these steps to help your loved ones prepare financially in the event the worst happens to you.

Career And Business / Family

A Smart Way for Philanthropists to Give More

A well-designed charitable remainder trust can help lower taxes and aid in financial planning.

Retirement Planning

The Challenges of Living Longer

The good news: Retirees are living longer. The bad news: That may mean retirees will have to fund more years of retirement.

Retirement Planning

Make the Most of Your Retirement With an Informed Income Strategy

Annuities offer another way to put a floor under your retirement income, providing an retirement income stream in exchange for an initial investment. Immediate annuities begin issuing payments soon after you make your investment, while deferred annuities are invested for a period of time before you start taking withdrawals. You can also choose between fixed (-rate) and variable annuities. Fixed annuities earn a guaranteed interest rate over time, while variable annuities are tied to the performance of an investment portfolio. Both provide monthly income for life and protection for your loved ones through a death benefit.

Estate Planning / Family

Finding a Way to Hand Over a Family Business

Creating a detailed succession plan is paramount for a smooth and profitable transition.

Family / Retirement Planning

Balancing the Care of Aging Parents and Children

There are ways to ease the burden of this high-stress juggling act.

Retirement Planning

Deciding When to Claim Retirement Benefits

Keys to Optimizing Social Security Income.

Home

How Tax Reform Impacts Retirement and Estate Planning

The new tax law will alter many decisions you may have to make when filing your 2018 taxes.

Retirement Planning

The Importance of Investment Diversification

Methodically placing assets in several baskets isn’t as thrilling, but helps you invest responsibly.

Estate Planning / Family

Protect Your Loved Ones With an Estate Plan

Taking a proactive approach to passing on your assets can help bring peace of mind to you and your family.

Retirement Planning / Home

Choosing a Financial Professional

When searching for the right financial professional for you, start with these 7 questions.

Retirement Planning / Family

Four Ways to Access the Value of a Life Insurance Policy

Life insurance isn’t only for your survivors: Find out how to use its cash value during your lifetime.

Retirement Planning

Women & Finances: Securing Your Retirement

Strategies to help make sure your retirement savings last for life.

Retirement Planning / Family

Women & Finances: Strengthening Your Finances After Divorce

Make sure your retirement plan is still on track.

Family / Home

Women & Finances: Moving Beyond the Loss

The loss of a significant other can offer an opportunity to learn about financial empowerment.

Retirement Planning

Weathering a Turbulent Market

Worried investors would do well to remember that historically, markets recover after a downturn.

Family / Home

The Surprising Affordability of Term Life Insurance

A life insurance policy isn’t as expensive as you think.

Family / Home

Get the Most Out of Your Annual Financial Check-Up

A yearly financial review is a good way to stay fiscally healthy.

Retirement Planning / Family

How to Buy an Annuity

Choose the right annuity plan that aligns with your financial goals.

Family / Home

6 Life Insurance Myths Debunked

Don’t let these common misconceptions prevent you from giving your family the protection they deserve.

Healthcare / Family

Planning for the Cost of Healthcare in Retirement

Trying to anticipate what you’ll spend on healthcare in retirement can seem daunting, but estimates can help you start preparing for the future.

Family / Home

The Benefits of Rethinking Work-Life Balance Before Retirement

Achieving better work-life balance now can help position you for a more fulfilling future.

Family / Estate Planning

How to Buy Life Insurance

These four steps can help you choose the best protection for you and your family.

Retirement Planning / Family

How to Lower Your Taxes in Retirement

You’ve worked hard to build your retirement savings. Now, make sure your money lasts by considering strategies to lower taxes.

Home / Family

The Importance of Financial Literacy

Learn about basic concepts regarding financial literacy: budgeting, saving, debt/spending, and financial management.

Retirement Planning / Family

Make the Most of Your Money with a Financial Plan

A financial plan can help you meet your needs today and reach your long-term goals.

Family / Home

Money Moves to Help You Feel More Confident

Build a stronger financial foundation with these four steps.

Family / Home

Supporting Multiple Generations

Tips for families with many generations living together so everyone stays financially healthy.

Family / Estate Planning

Securing Your Family’s Future

Having an estate plan is essential to maintaining your family’s financial security.

Retirement Planning / Family

4 Ways to Help Turn Income Into Wealth

Build your wealth by incorporating these strategies into your financial plan.

Career And Business

Why Employee Benefits Matter

The key to attracting top talent goes beyond trendy perks.

Retirement Planning / Family

How Much Life Insurance Do I Need?

These key factors can help you figure out your life insurance sweet spot.

1 For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2) (i.e. the transfer-for-value rule); arrangements that lack an insurable interest based on state law; and an employer-owned policy unless the policy qualifies for an exception under IRC Sec. 101(j).

2 For federal income tax purposes, tax-free income assumes, among other things: (1) withdrawals do not exceed tax basis (generally, premiums paid less prior withdrawals); (2) policy remains in force until death (any outstanding policy debt at time of lapse or surrender that exceeds the tax basis will be subject to tax); (3) withdrawals taken during the first 15 policy years do not cause, occur at the time of, or during the two years prior to, any reduction in benefits; and (4) the policy does not become a modified endowment contract. See IRC §§ 72, 7702(f)(7)(B), 7702A. Any policy withdrawals, loans and loan interest will reduce policy values and may reduce benefits.

3 Indexed universal life insurance products do not directly participate in any stock or equity investment.

The results and explanations generated by the calculator on this page may vary due to user input and assumptions. This information may not be used to project or predict future results. Pacific Life does not guarantee the accuracy of the calculations, results, explanations, nor applicability to your specific situation. we recommend that you use this tool as a guideline only and ultimately see the guidance of an experience professional. CalcXML, the provider of this information and interactive calculator, is an independent third-party and it not affiliated with Pacific Life.

The information above, including the results and explanations generated by the calculator, is provided for informational purposes only and should not be construed as investment, tax, or legal advice. Information is based on current laws, which are subject to change at any time. You should consult with their accounting or tax professionals for guidance regarding your specific financial situation.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life’s Home Office is located in Newport Beach, CA.

PL33A